The 'Wisdom' of the Crowds

Markets at all-time highs, multiple offers on all things real estate, lumber price sticker shock… All occurring while many of us are still barred from visiting friends and family! What’s going on and can it continue? In this month’s Innova Market Insights, we discuss the on-going ‘Everything Bubble’ and how we are positioning the portfolio amid this madness.

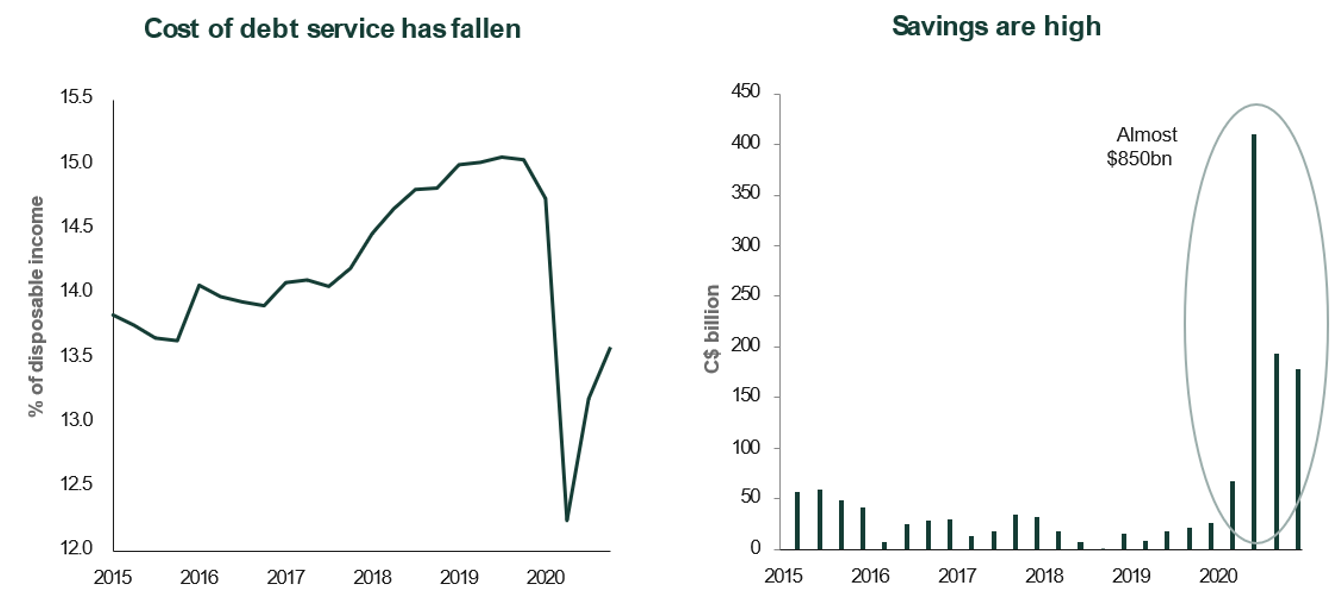

Source: Statistics Canada, CC&L Private Wealth

Fueled by ‘cheap’ money in the form of low-interest rates[i] and record-high savings among consumers[ii], the number of buyers of all investable assets is outpacing the number of sellers and new entrants. In turn, this scarcity puts upward pressure on prices and can occur by means of the sudden need to substitute a good. For example, very few people can or want to travel overseas at present, so they are satisfying the travel itch by purchasing a recreational vehicle. Given that RV manufacturers cannot double production overnight, especially when impaired by Covid restrictions, scarcity presents itself and manifests with higher prices.

The same is happening on the stock market. With interest rates at all time lows, saving in a bank account gets you nowhere and bond investing carries its own risks (IMI: Bothersome Bonds) with bond indexes losing as much as 5% in the first three months of this year[iii]. As a result, investors are turning to stocks and real estate to park their savings. There are 50% fewer publicly traded companies on the US stock market than there were 20 years ago[iv] and real estate takes time to build, even when not hampered by Covid -- both factors that increase scarcity, and thus push prices up.

In times like these, it is important for us to remain focused on our objectives and not get carried away chasing an ever-inflating price bubble.

To many, the stock market is used to place bets, little more than a glorified casino. Similar to a casino, people have all kinds of ways they think they can game the system. These ‘strategies’ can range from the simple, like piling into GameStop or AMC with hopes of triggering a short squeeze, to the complex, like factor rotations and gamma hedging. You name it, someone has tried it.

At the end of the day, our team at Innova does not approach investing like a casino game, but rather as caretakers of a pension, an education plan, or a future inheritance. We avoid getting caught up with the newest fads, or panic when the market moves in directions we think are short sighted. We stick to the fundamental, tried, and true strategies of finding good companies at the right price that can grow their earnings consistently over time. By learning from the investment giants of the past, we stand on their shoulders and see the forest from the trees. With this perspective and our long view, we continue to favour the Amazons over the Carnival Cruise Lines, regardless of what the stock market is posting.

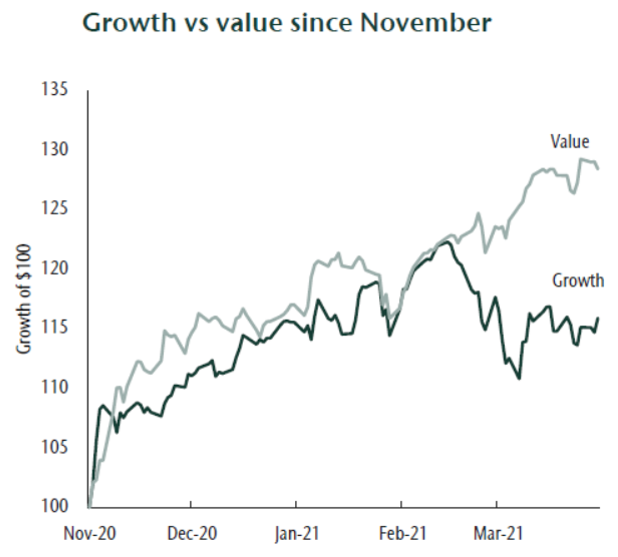

As we noted in our February commentary, a large part of the stock market initiated a ‘market rotation’, selling stocks that did exceptionally well in 2020 in favour of those who have struggled. This trend has been particularly acute with companies that thrived during Covid (Amazon) compared to those who have struggled (Carnival Cruise Lines). One would be hard-pressed to take the view that the economic prospects of cruise lines is more favourable than that of an e-commerce giant, but so far this year, that is what the markets are rewarding.

The chart below shows the market bifurcating from growth stocks to value stocks in mid February.

Source: Bloomberg, CC&L Private Wealth

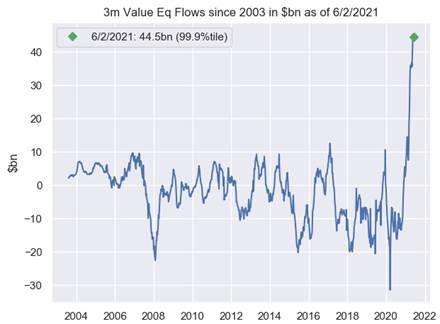

Fund Flows into Value Funds

A revealing example is the difference between Amazon and Carnival Corp’s returns from February 18th to June 1st, when the bulk of this market rotation occurred. Carnival is up 31% over that period, while Amazon is down 3%.

Fundamentally, if a company is unable to sustainably grow their revenues by more than 6% per year while interest rates are at all time lows, we can't expect its stock price to do so. The market bet seems to be that companies in stale industries that have been unable to create organic growth pre-pandemic, will now be able to do so. We feel that even with substantial government assistance, this is a long shot.

Rather, we feel that innovative companies with dominant positions in expanding markets present the best place to allocate capital long term. Though this is out of favour in the near term, we believe that time will vindicate the decision to hold Amazon or Carnival Cruise Lines.

As long-term investors in quality companies, we did not take part in this rotation, despite recognizing it early on. Simply put, we are sticking to what works rather than betting on the next GameStop trade.

We thank you for your continued trust in our management and remain available to you as needed.

Sources

[i] Do Fed Policies Fuel Bubbles? Some See GameStop as a Red Flag: https://www.nytimes.com/2021/02/09/business/economy/gamestop-fed-us-economy-markets.html

[ii] How Has the Pandemic Impacted U.S. Savings Rates? https://time.com/nextadvisor/banking/savings/us-saving-rate-soaring/

[iii] FTSE Canada Fixed Income: https://research.ftserussell.com/products/FTSETMX/Home/Indices

[iv] Chasing Right Stocks To Buy Is Critical With Fewer Choices But Big Winners : https://www.investors.com/news/publicly-traded-companies-fewer-winners-huge-despite-stock-market-trend/

Disclaimer:

Aligned Capital Partners Inc.(ACPI) is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Investment products are provided through ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Please contact Jean-François Démoré or Cliff Richardson, or visit https://invest.innovawealth.ca for additional information about the Innova Tactical Asset Fund. All non-securities related business conducted by Innova Wealth Partners is not as agent of ACPI. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Jean-François Démoré or Cliff Richardson.

Information has been compiled from sources believed to be reliable. All opinions expressed are as of the date of this publication and are subject to change without notice. Content is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The information contained does not constitute an offer or solicitation to buy or sell any investment fund, security or other product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI. For current performance information, please contact Innova Wealth Management of Aligned Capital Partners Inc. Important information about the Fund is contained in the offering memorandum which should be read carefully before investing.

- Hits: 7324