Achieve Financial Independence with Tailored Solutions

You work hard for each and every dollar you earn, so it’s important that your finances are well managed. Consulting a financial advisor can provide essential guidance in managing your finances and achieving your financial goals. As you progress through the different stages of life, your financial goals and financial needs change, known as the Financial Life Cycle. Innova Advisors work with you throughout all the stages of life as your goals evolve, identifying the best means of achieving them given your particular financial situation throughout.

What is Financial Independence?

Financial independence is a state of being where an individual has sufficient wealth to live comfortably without being dependent on a regular income. It means having the freedom to pursue one’s passions and interests without being burdened by financial stress. Achieving true financial independence requires discipline, patience, and a well-planned strategy. It involves creating a sustainable income stream, managing debt, and building wealth over time.

On-Going Process of Minimizing Income Tax

Capital Preservation

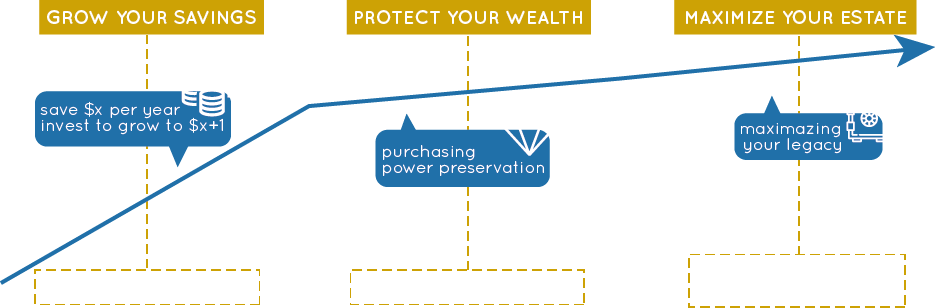

See below for more information on the stages of the Financial Life Cycle

Frequently Asked Questions

According to the 4% rule, which is a general guideline for retirement planning, a retiree should take out 4% of their total retirement funds in their first year and then that same amount each year after that for approximately 30 years, adjusted for inflation. For those considering early retirement, the 4% rule can be a useful guideline to ensure that your savings last throughout your retirement years. This rule’s objective is to assist in creating a reliable and secure income stream that will cover a retiree’s present and future expenses.

For example, if a client has a portfolio at retirement that equals $1,500,000, they would withdraw $60,000 in their first year. Let’s say there was a 3% jump in inflation the next year, then they would withdraw $61,800. They’d follow this rule for their remaining years. You can also do the calculation backwards to determine how much you’d need to save to have a desired annual withdrawal. If you wanted to receive $40,000 each year, you would need a portfolio of $1,200,000 (Annual Expenses x 30 Years).

Having enough assets to support yourself without working and live off the profits of your investments is known as financial independence. You can use the 4% rule as a guide to determine how much you must save in order to reach financial independence. As discussed, by aiming for the 30 times multiplier of your anticipated yearly expenses, you may calculate when you will have enough money for retirement.

Although it is not necessary to use this rule, it does serve as a useful guideline and starting point when planning for retirement. Given your unique circumstances, the 4% rule may or may not work for your personalized plan, which is why it is important to plan for your own goals for retirement in advance.

Saving and investing are pivotal in achieving financial freedom and independence, primarily because they have a direct impact on how much money you make and how much it grows over time. By adopting effective saving and investing strategies, you can reach financial freedom and secure your financial future.

Saving: Saving establishes the groundwork for accumulating wealth, which is the basis of financial freedom. Your reserve will grow more quickly the more you save. But saving on its own won’t get you to financial independence; you need to save a lot of money and supplement it with wise investments.

Important elements of saving consist of living below your means, being consistent, and having an emergency fund. Your journey to financial independence can be accelerated by living frugally, reducing wasteful spending and making saving a greater priority. Consistently putting aside a portion of your salary (automating savings is beneficial) guarantees ongoing advancement toward your financial objectives. Over time, the more consistently you save, the more your wealth will increase. Setting aside money for unforeseen needs, such as large repairs or medical emergencies, helps you avoid being set back from becoming financially independent. You may prevent premature withdrawals from your investment accounts, which could restrict growth in your investment portfolio, by keeping an emergency fund.

Investing: Although the capital is provided by saving, investing enables it to increase over time, frequently at a rate far faster than inflation. If you didn’t invest, inflation would reduce the purchasing power of your funds. You can increase your wealth more quickly with a few options for investments than with savings alone. Examples of these include stocks, bonds, real estate, and enterprises.

The idea of compound interest is among the most powerful elements of investment. Your investments yield returns over time, and those returns in turn yield more returns. If you invest for the long run, this snowball effect can significantly enhance your wealth. Your money has more time to grow the earlier you start investing. Selecting a varied range of investments, such as stocks, bonds, real estate, etc., aids in striking a balance between risk and return. Long-term investors typically have a larger allocation to stocks, particularly index funds, because equities have traditionally produced superior returns over longer time horizons, despite their higher short-term volatility. Although investing carries a higher risk than saving, it also yields higher rewards.

The relationship between these is that saving allows you to invest, and if you choose not to invest, you miss out on the chance to enable your funds to compound and grow even greater over time.

Reducing your living expenses is a great way to get one step closer to achieving financial independence. Finding ways to save money in your daily expenditures can significantly accelerate your path to financial health and independence. Here are a few ways to cut living costs without sacrificing quality of life:

Understand Your Spending: The only way to know where your money is going is to track and analyze your spending habits. The use of a spreadsheet, budgeting app, or an old fashioned pen-and-paper method, can help you identify exactly what comes in, and what goes out your monthly budget, on a monthly basis. From there, you can categorize expenses into groups, such as transportation, housing, food, entertainment, etc. to spot any patterns, and areas in which you can improve.

Housing: If your home is costing you a significant amount each month, and you find yourself questioning your living situation, it may be time to consider downsizing. If you do not need as much space as you have, moving to a smaller place is not only beneficial in terms of cost, but also in the amount you have to clean! If it’s not the size of the home, it may be the area it is in. Relocating to a more affordable spot, though the commute may increase, your expenses will decrease. If moving away isn’t ideal, and you have a room to spare, consider living with a roommate - this will cut your costs in half! Furthermore, refinancing your mortgage to a lower interest rate may also cut your monthly payments if you own a property, giving you more financial flexibility.

Transportation: Consider switching to a more economical, fuel-efficient vehicle to cut down on transportation expenses, or if public transportation is easy and available, consider giving up your car and investing the money you save. By splitting the cost with others, carpooling or using rideshare services might help reduce costs if you still require a car. Additionally, if you live in a location that is bike-friendly or walkable, choosing to walk or bike rather than drive will save you money on maintenance, insurance, and gasoline, which will further lower your overall transportation expenditures and also keep you healthy!

Food & Groceries: The first step in cutting food expenses is to plan your meals and cook at home rather than constantly ordering takeout or dining out, which can be very expensive. Reduce your intake of pricey restaurant meals or high-end foods and instead concentrate on more reasonably priced, nutrient-dense foods like rice, beans, veggies, and lean proteins. To save as much money as possible when grocery shopping, use cash-back apps, coupons, and deals. Utilize leftovers, freeze extras, and keep watch of expiration dates to make sure food is eaten before it goes bad in order to reduce food waste. You can still eat wholesome, filling meals while saving money by using these tips.

Entertainment: Consider canceling or downgrading subscription services like cable, streaming services, or magazines in order to lower your entertainment and leisure costs. There are plenty of free or reasonably priced alternatives available. Investigate free or inexpensive activities like biking, hiking, and going to local events. Free festivals, museums, and concerts are also available in many places. Establish a “cooling-off” time, such as 24 hours, before making non-essential purchases to help you avoid impulsive purchases. You may keep within your budget and still enjoy your leisure time by using these methods.

Other Expenses: There are a number of other expenses you can analyze to see if there are any additional costs you can reduce, or eliminate altogether. Things like clothing and personal care, being more creative with socializing rather than always going out, swapping bought gifts for homemade gifts, among others, are small decisions that can add up to a lot of savings.

Planning, adaptability, and careful prioritizing are necessary when juggling financial independence savings with other financial objectives like home ownership or education funding. For example, saving for college can help your children avoid student debt, which is a significant financial burden for many families.

The best approach starts with defining your goals. Clear objectives, with timelines and target amounts, will help you prioritize what are immediate versus future needs, the risk level you are prepared to take on, and opportunity costs to achieve these goals.

After you have reviewed your monthly revenue and expenses, you are able to then determine your available savings. This is where you can decide how much to allot to each goal. For example, if after your expenses you save $1,000, you may put 50% towards your long-term goals such as retirement, and the other 50% towards your education, which is more immediate. This is dependent on your goals, as the more you have, there will be adjustments to each percentage.

If you have decided on a set amount, you can set up automatic transfers to occur so that you don’t even have to think about saving! If your financial circumstances change, you can always change this amount. This is part of evaluating and revisiting your goals periodically to ensure that you are on the right track.

Achieving other significant financial milestones, such as purchasing a home or paying for school, can coexist with saving for financial independence if you have clear goals, evaluate your progress frequently, and make well-informed financial decisions often about how to divide your money.

As you prepare for retirement, you must ensure that you have sufficient funds to sustain you over time. Ensuring that your bank account grows at a rate that outpaces inflation is crucial for maintaining your purchasing power over time. Regrettably, inflation can reduce the value of your investments and pensions. Because of this, you must take inflation into account when planning for your retirement.

How is your purchasing power impacted by inflation?

The same amount of money can purchase fewer products and services over time due to inflation, which in turn reduces your purchasing power. If your income doesn’t keep up with inflation, you might not be able to save as much or maintain the same standard of living. Fixed-income investments have the potential to lose real value if their returns do not exceed inflation. Investing in assets like equities or real estate that often outperform inflation is crucial for preserving buying power, as is accounting for inflation in long-term financial goals.

What impact might inflation have on retirement funds?

The value of money decreases as inflation raises living expenses, which means that in the future, the same amount of money will purchase fewer products and services. Your purchasing power in retirement may be far less than you had projected if your retirement savings aren’t increasing faster than inflation. For instance, the cost of products and services will double approximately every 24 years if inflation averages 3% annually. As a result, the money you save now might not be sufficient to support your future expenses. Furthermore, the value of your funds may be further diminished by fixed-income investments such as bonds or savings accounts that yield returns below inflation.

How can financial planning take inflation into account?

It’s crucial to take inflation into consideration while making financial plans by taking into account how growing costs will affect your future investments, savings, and spending. To begin, project future costs using an inflation estimate, usually 2-3% per year, to account for anticipated living expenses, medical bills, and large purchases. For instance, if you plan to need $50,000 annually in retirement, you would raise that sum annually by the anticipated rate of inflation to make sure it matches future living expenses. Ensure your investment strategy focuses on outpacing inflation, adjust your retirement savings to reflect inflation, review your plan regularly, and consider inflation-adjusted income sources such as Canada Pension Plan (CPP) and Old Age Security (OAS).