Are Bonds Worth It?

Among the many difficulties that investors faced in 2023, the unprecedented losses in the historically safe U.S. Treasuries may have been the most predictable. Bank of America named it "the greatest bond bear market of all time"[i], and yet, a plucky little investment firm in Sudbury, Ontario warned investors about the coming carnage in a 2020 newsletter entitled ‘Bothersome Bonds’.

Fast forward four years and we have now reversed course, almost quadrupling our allocations to bonds since the beginning of 2023. This quarter’s newsletter will outline our strategy and why we are now taking the opposing side of our previous position in our asset allocation for clients.

With the past few turbulent years of investing, client inquiries regarding more defensive products such as guaranteed investment certificates (GICs) are increasing, making this a good time to dive into the characteristics of major fixed income security types and what differentiates them. We will also discuss bond investing, interest rate policy, our forecasts heading into this year, and what we are doing to take advantage of these current economic conditions.

High Interest Savings Accounts

All Canadians are familiar with the interest (or lack thereof) they earn on their deposits at the bank. As investment managers, we also have access to high-interest savings accounts (HISA) that pay interest on deposits. As investment advisors, we can quickly move dollars between institutions to get the best rates, so competition has made the products we can access generally more appealing than those available at your local bank. The rates fluctuate based on similar economic factors to those that affect mortgage rates, but are also closely tied to the policy rate determined by the Bank of Canada. This “floating rate” can fluctuate without notice at the financial institution’s discretion and is not guaranteed for any future period.

For the most part, deposits are insured by the Canada Deposit Insurance Corporation (CDIC) up to $100,000 per individual, per account. Thus, even if a financial institution were to go bankrupt, you would be entitled to your money according to the following graphic:

Source: cdic.ca

HISAs can be especially beneficial for investors saving for large purchases in the near term, such as a house or a car, where the principal is protected but decent interest can still be earned while the money is set aside.

For taxable accounts, you must include all the interest you earn throughout the year on your tax filing. It will then be added to all your other forms of income (such as employment income or rental properties) and subject to regular marginal tax rates (20% to 54%).

Guaranteed Investment Certificates

Conventional guaranteed investment certificates (GICs) are deposits to a bank or financial institution in which they promise to pay you interest at a fixed rate. The ‘term’ is the period of time (1-year, 2-year, 5-year, etc.) until the GIC matures and you are returned the principal amount of your investment, along with the interest that has accrued.

For example, let’s say you invest $10,000 in a 3-year GIC with an annual interest rate of 5%. Each year, the interest is calculated on the initial investment, and the investor can choose to receive that interest in the form of a payout, or reinvest the interest earned to compound it. Here's how the interest would accumulate over a three-year period in a compounding GIC.

|

Start of Year |

Interest Earned |

End of Year |

|

|

Year 1 |

$10,000 |

5% = $500 |

$10,500 |

|

Year 2 |

$10,500 |

5% = $525 |

$11,025 |

|

Year 3 |

$11,025 |

5% = $551 |

$11,576 |

At the end of the 3-year term, your investment would be worth $11,576. This amount includes your initial investment of $10,000 plus the accumulated interest over the three years ($1,576). Similar to high interest deposits, all the interest income earned in taxable accounts must be reported on your income tax filing and will be subject to marginal rates.

Unlike high-interest savings accounts that are relatively liquid, it is important to note that investments in GICs are ‘locked-in’ until they mature. Some may allow you to withdraw funds early (cashable), but this option often comes with a penalty or considerably lower returns. Similar to deposits, conventional GICs are usually eligible for CDIC deposit insurance against bank failure.

Market-Linked GICs and Structured Notes

Given the interest in ‘guarantees’ in the investment world, financial institutions have created several products that seek to offer a worse-case scenario return. They are available in thousands of combinations, but are often linked to an underlying index or reference portfolio. One popular example is market-linked GICs in which your original principal is guaranteed by the bank, but your return is tied to the performance of the broader stock market and often subject to an upper limit. The marketing of these vehicles often coincides with the most attractive times to buy stocks, wherein the bank seeks to profit from the upside by using your money through the use of derivatives. We make use of these products inside the defensive and tactical pools, and occasionally offer them to risk-averse clients when we deem them to be attractive. Despite the returns of these vehicles being tied to stock markets, the income tax characteristics are usually interest income, which means the profits are fully taxable at your marginal tax rate, similar to the other interest-earning products.

Bonds

The investment mechanics of a bond are similar to GICs. When you purchase a bond, you are lending money to the issuer (a corporation, municipality, or the government) who promises to pay you back on the maturity date. As with most loans, the issuer pays interest at a fixed rate, also known as the ‘coupon rate’, as compensation for using your money. Similar to GICs, the amount of interest earned depends on the Central Bank of Canada’s policy rate, but unlike GICs, also depends on the borrower’s creditworthiness. This factor is important because if the issuer goes bankrupt or defaults on the bond, the lender has the right to some of that issuer’s liquidation proceeds.

The key characteristic that differentiates bonds from their fixed-income counterparts is that they can be traded on the open market. Therefore, bonds have a market value that fluctuates daily based on interest rates and market conditions, whereas GICs and HISAs are static and do not fluctuate in value. As such, it is possible for your bond pay you a significant interest rate (maybe even higher than a GIC), but for the price of that bond to have fallen so much that your investment loses value. Assuming no default, you will get all of your interest and all of your principal when the bond matures, but the intervening price movements can, in some cases, temporarily wipe out those gains and actually show losses. The interest earned is subject to taxation at your marginal rate, whereas the price movements can be taxed as capital gains/losses, for which only 50% of the taxable portion is included on your tax return.

To summarize thus far, high interest savings are deposit products that are fully liquid and have a variable interest rate. GICs have a predetermined term of deposit with guaranteed principal and rates, and do not fluctuate in value. Bonds involve lending money to governments or corporations, often at a fixed rate of interest, and can be traded anytime.

|

HISA |

GIC |

Bond |

|

|

CDIC Eligible |

Yes |

Yes |

No |

|

Guaranteed by issuer |

Yes |

Yes |

No |

|

Interest Rate |

Variable |

Fixed |

Fixed |

|

Term |

Daily |

1-6 years |

1-40 years |

|

Liquidity |

Daily |

On maturity |

Daily |

|

Price Fluctuation |

None |

None |

Daily |

|

Valuation |

Interest-only |

Interest-only |

Price of bond + interest earned |

Bonds, Interest Rates, and Duration

With an improved understanding of the features of these investment classes, we can explain what has transpired over the past three years on the bond market, and perhaps more importantly, what is to come! Despite having fixed interest rates, the fact that bonds are priced daily has resulted in significant ‘paper losses’ for investors.

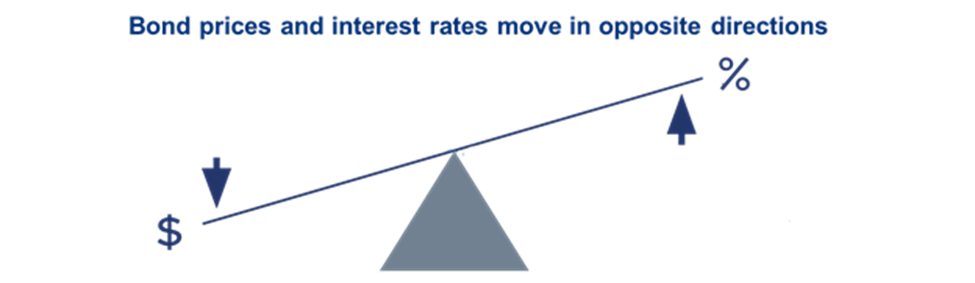

Avid readers may recall the ‘Bothersome Bonds’ article that we published in October of 2020, where we took a deep dive into the principles of bond investing. We focused on two principal characteristics; bonds' relationship with interest rates and a concept known as ‘duration’. For those who have not read the article or who need a refresher, here is the verbiage we used back then which still holds true today:

“Let’s say you purchased a 10-year Government of Canada bond at 10% interest per year for $10,000, ten years ago. You essentially purchased a piece of paper on which the government has promised to pay you your $10,000 principal in 10 years as well as $1,000 per year for all ten of those years (10% of $10,000). (…) Assuming no substantial changes in the default risk of the Government of Canada, the rate at which they issue new bonds, say 5%, will have a substantial impact on what people are willing to pay you for your $10,000 promise from the same bond-issuer. This influence is because a new bond, or promise from the same borrower, at 5% will receive $500 per year instead of your $1,000 per year, thus making your promise to pay more valuable.

Since the risk of default has not changed, your bond will need to be priced to offer the same rate of return to investors as those offered by newly issued bonds. If rates on new bonds go DOWN, your older bond is paying more interest and so its market value will go UP. If rates have gone UP, and new investors receive more interest than you are offering, the price of your bond will go DOWN. This phenomenon is known as a negative correlation.

Fortunately for us, the bright minds of finance have derived a formula that provides a good approximation of what impact the rise or fall of interest rates might have on the market value of your investments. Known as duration, this one number gauges the percentage gain or loss on your portfolio due to changes in interest rates.

Source: https://investspectrum.com/uma/tag/high-yield-bond/

For example, a bond with a duration of 5 will lose 5% for every 1% increase in interest rates. A 1% drop in interest rates would mean a 5% gain to those same investors thanks to the negative correlation discussed earlier. All of which means, it is imperative that long-term bond investors pay close attention to their portfolio’s duration to understand the impact that interest rate changes might have.”

When we wrote this article in 2020, we discussed why we were reducing our allocation to bonds and favouring other asset classes like stocks and alternative investments in the portfolio. At that time, the Bank of Canada’s interest rate was at 0.5%, and we were cognizant of the fact that rates were likely to increase in the foreseeable future. Fast forward to today, and the current bank rate sits at 5.25%, an increase of 4.75%. From the previous example, the price of a bond with a duration of 10 would have fallen up to ~47.5% (10 x 4.75% increase in rates) over this period. Fortunately, our decision to tactically reduce our exposure to bonds in the Tactical Pool in 2020 shielded our clients from the blood bath.

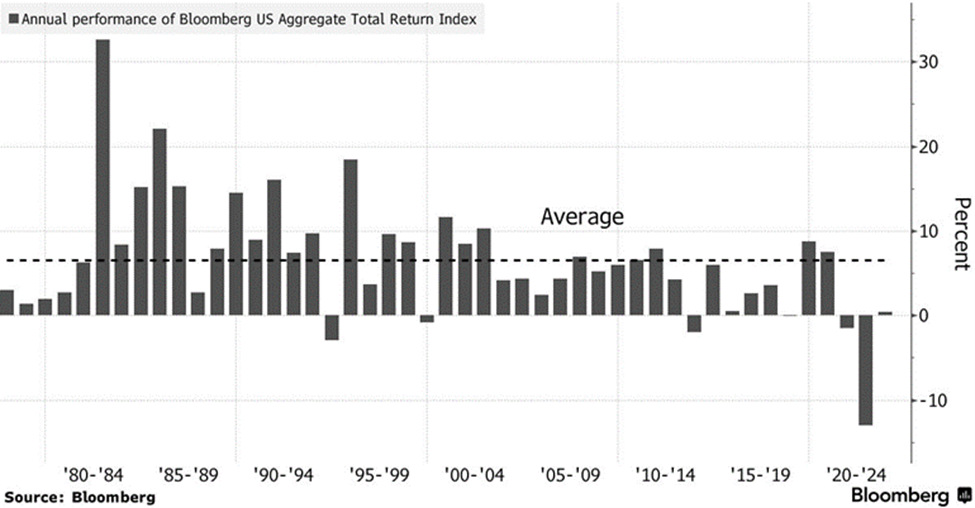

Historically Terrible Time for Bonds

In general, bonds are meant to act as the ‘safety net’ of the portfolio. Stocks are where we allocate for long-term growth and higher return potential, knowing that there are likely going to be larger swings and higher volatility over short periods of time. Bonds often exhibit an inverse relationship with stocks and are meant to act as a steady diversifier when the stock markets are not performing well.

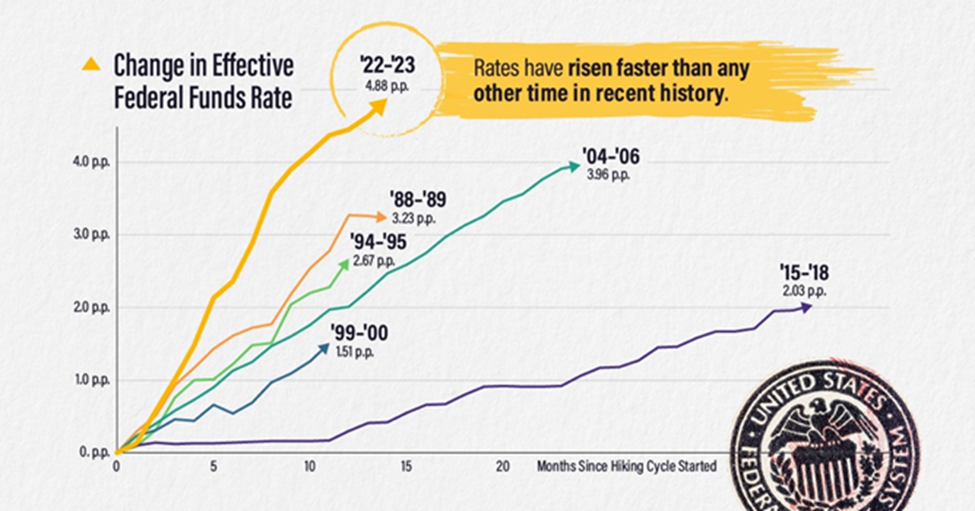

As mentioned above, the Bank of Canada and the American Federal Reserve have raised rates significantly over the last three years, specifically between 2022 and 2023 (the fastest and sharpest increase in the last four decades), as shown in the graphic below:

Source: https://www.visualcapitalist.com/interest-rate-hikes-1988-2023/

As you can see, during the last rate hike it took three years to increase just 2%. This time around, they were hiked by more than double that amount in one third the time. Given our previous example, it would be evident that bonds have performed poorly since our ‘Bothersome Bonds’ prediction in 2020.

In 2022, the return on 10-year U.S. Treasury bonds was -15.7%, making it the single worst year for bonds since the 1800s.

Although it is clear how dismally bonds can perform when interest rates rise sharply, the inverse is true when we forecast declining rates. Contrary to our hypothesis in 2020 and given current economic conditions, we are now taking the opposite position and have been increasing our bond exposure to capture what we think could be unprecedented upside.

Current Economic Conditions

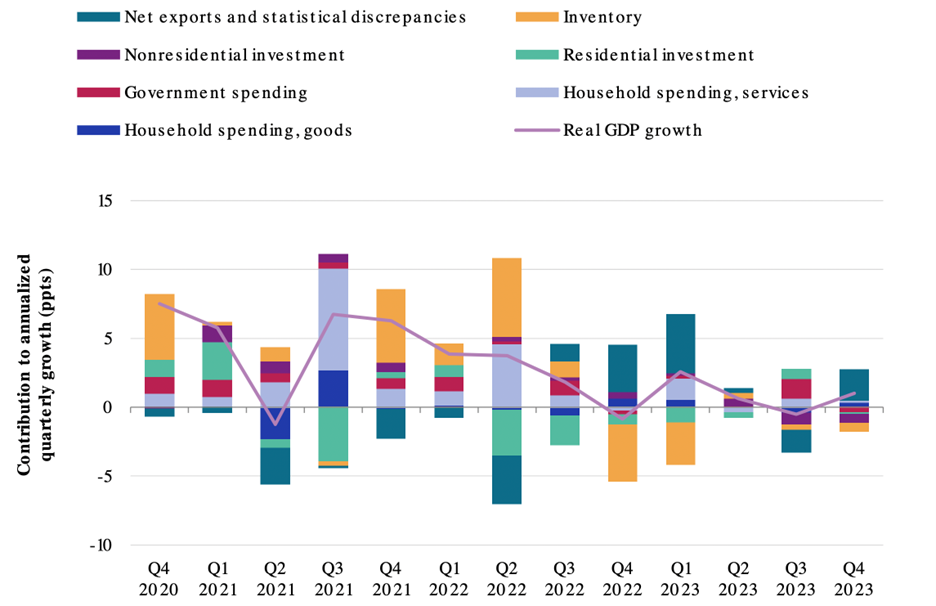

The Bank of Canada has kept rates stagnant over the last ten months at a bank rate of 5.25%. Although still not at their 2% target rate, inflation has eased in the country and the real estate craze we have experienced over the last few years has abated. Economic growth, often measured by gross domestic product (GDP), has also slowed considerably since the rate hikes:

Source: S&P Global

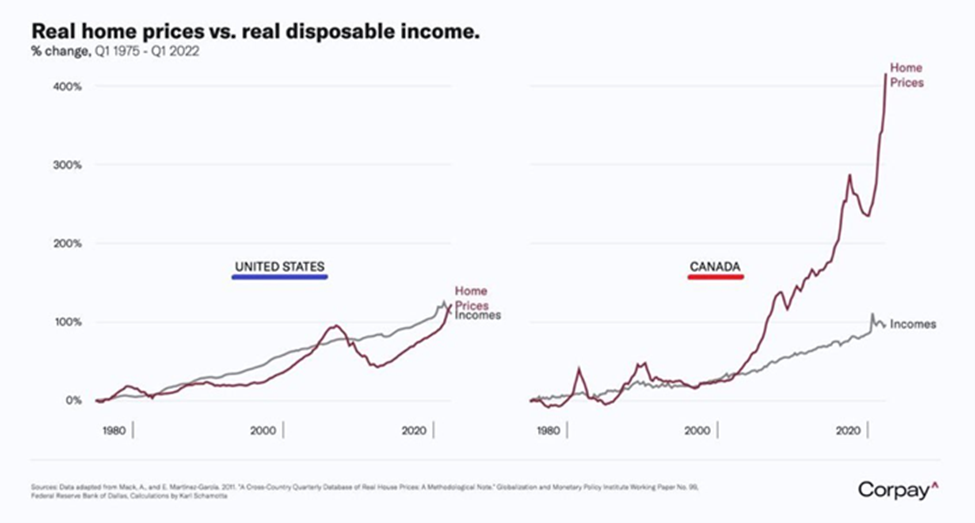

Additionally, Canadians are more susceptible to higher interest rates than Americans. Firstly, Canadians have much higher levels of household debt due to substantially higher home prices relative to income. This situation is amplified when rates rise:

Source: https://www.corpay.com/

Furthermore, the mortgage structure in Canada is different from the United States. In Canada, a significant portion of the population holds variable-rate mortgages, where the interest rate is tied to the prime rate. Thus, increases in our Central Bank's policy rate directly impacts mortgage rates. In contrast, fixed-rate mortgages are more common in the United States, and provide greater stability in mortgage payments despite interest rate fluctuations.

In summary, although the Bank of Canada and the Federal Reserve historically tend to move in similar directions regarding interest rate policy, we believe that the Bank of Canada will likely be the first to reduce rates.

Our Tactical Decisions

Since we believe that rates are likely to come down in the foreseeable future – and have the ability to quantify profits for every percentage point decrease thanks to duration – we have been increasing our bond exposure while focusing on duration as the driving factor to the upside we aim to achieve in our portfolios. Specifically, we have been tactically adding to long-term government and corporate bonds that provide a good combination of positive duration risk, with little default risk.

The expectation here is that should interest rates decline, the bond portion of the portfolio will greatly benefit. These investment products have the added benefit of being a great diversifier to the stock market, which is correlated with the general economy and performs well during good times. When the economy enters a downturn, central banks generally support the economy by cutting interest rates, which, as we explained, will benefit bonds.

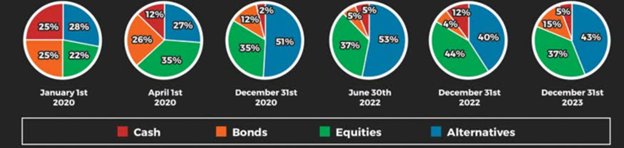

The Innova Tactical Asset Allocation fund can move between stocks, bonds, cash, and alternatives to generate the most attractive return relative to risk. Over the past four years, we have tactically shifted the allocation to bonds in the portfolio from 26% in 2020, down to 4% in 2022, and now find ourselves at 17% at the end of April, 2024.

Rather than tactically adding or removing to asset classes based on market conditions, our two other strategies take a more prescriptive approach. The Enhanced Growth offering has no direct exposure to bonds, while the newly launched Dedicated Defensive will always have at least 40% exposure to bonds.

Dedicated Defensive

At the time of writing, the Dedicated Defensive pool holds 47% bonds with further allocations expected during the portfolio construction phase. Rather than focusing our allocations on high duration products, we are taking a more cautious approach to bonds inside this portfolio. Our intent is to protect investors in case our investment thesis of falling interest rates does not materialize, or an economic surprise causes them to rise further. This ‘defense-first’ approach means that we placed 20% of the portfolio in long-dated GICs.

Our largest position at present is a 6-year GIC paying 5.45% annually. The advantage of the pooled fund structure is that investors can buy and sell exposure to this investment on a weekly basis, rather than being ‘stuck’ in the GIC themselves. Our scale has allowed us to negotiate better rates than are typically available to retail investors, and to layer multiple conventional and structured products together to provide clients with a diversified portfolio.

Due to the historical attractiveness of the rates we have secured, combined with the expected positive effects of duration on the portfolio, we expect the Dedicated Defensive portfolio to perform well over the near-term.

More importantly, it acts as a crucial third pillar to our proprietary investment line-up, allowing us to combine this position with the Tactical of Growth mandates to match risk and return to client’s objectives and tolerance in a cost-effective wrapper.

We thank you for your continued trust in our stewardship and remain available to you to discuss the specifics of your accounts.

[i] https://markets.businessinsider.com/news/bonds/treasury-bond-rout-yields-soaring-interest-rates-bank-of-america-2023-10?utm_medium=ingest&utm_source=markets

- Hits: 6363