The Evolution of Private and Public Markets

As we continue to analyze the investment landscape going into this post-pandemic era, it is important to recognize how markets are evolving in both the public and private sectors.

The Public Markets

The public markets are traded on exchanges that are easily accessible to the public and include asset classes like stocks, bonds, mutual funds, and ETFs. Regulated, well-known exchanges include the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE), and the NASDAQ report daily on the news, and are where you find some of the world’s most influential companies like Apple and Amazon. These exchanges act as middlemen matching buyers and sellers and facilitating the transaction of small portions (shares) of companies. To make the process easier, companies typically strive to keep their share price in the $20-$500 range where they can easily be bought and sold in pieces.

For example, at the time of this writing, Amazon has approximately 10.26 billion shares outstanding, each of which trade at ~$130(1). This sets the total value of Amazon, known as its market capitalization, at ~1.34 trillion dollars! Thanks to the public markets, anyone can buy or sell a single share of that company with as little as $130 plus the trading commissions to the exchange.

The process of ‘going public’ is accomplished through an initial public offering (IPO) in which the owners and shareholders of a privately held company decide to sell a portion of the company on an exchange. This is often used by companies seeking to access larger amounts of capital to finance their growth aspirations.

The public markets have been a staple way of investing for more than one hundred years, and for good reason. The S&P 500 – a committee-selected list of 500 leading publicly traded companies in the United States - has returned ~9.82% annually since its inception in 1928 (2)! Public equities have also been a core feature of our tactical strategy - “buying low” when stock prices are historically cheap and attractive, and “selling high” when the markets recover. An added benefit is their level of liquidity – you can essentially buy or sell these securities on any given week from Monday to Friday, offering quick and easy access to cash.

S&P 500 Growth Since Inception

For all the benefits of public markets, listing on exchanges also introduces a lot of costs and additional constraints to companies[i], which include:

- Specific accounting and reporting standards

- High frequency valuations of underlying assets

- Conference calls, analyst meetings, etc.

- Public scrutiny of all shareholders, intellectual property and financials

- Short-term focus (Quarterly earnings > Long-Term Earnings)

For these reasons, some companies have opted out of public markets having preferred to be ‘Private’.

The Private Markets

On the other hand - and often less understood by the typical investor - are the private markets. Simply put, these are investments that do not trade daily on stock exchanges and can include investments in private equity, real estate, infrastructure, agriculture, venture capital, etc.

They can be owned by one individual or shared by thousands and are not limited by size. The medium in which the exchange of ownership occurs is the defining factor. Specifically, parties seeking to sell their stake in these investments need to find their own buyers or find a broker to assist.

Our readers will be familiar with buying and selling real estate in this manner. The price is not set by the general market as each individual property is unique and will be set by agreement between the buyer and the seller.

Unlike public markets, investments held privately cannot be converted to cash daily, and are considered less ‘liquid’. For that reason, investment companies or financial products that invest in these ‘illiquid’ assets tend to set lock-in periods for their investors. For example, a company who invests in long-term care homes which require a provincial license to operate cannot liquidate its portfolio overnight. An investor seeking to convert their holdings to cash must either find their own buyer or wait until the fund manager can find the cash to meet the seller’s needs.

Additionally, these private products often have high minimum capital requirements to get your foot in the door, and because of this, investors typically consist of ultra-high net worth individuals, large institutions, or pension funds.

Despite these additional hurdles, the overall markets have been changing with private markets gaining popularity.

“Shrinking” Public Markets

An important trend to consider over the last few decades is the concept of “shrinking” public markets.

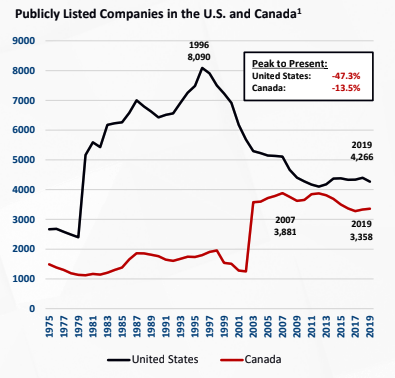

In 1996, the United States had over 8,000 publicly traded companies. Fast forward to 2019, and this number has been almost cut in half to 4,266. In Canada, public companies declined 13.5% from 2007 to 2019 (3).

Why the shrinkage? One of the main reasons is private buyout firms purchasing public companies and taking them off the markets, back to being privately held. In 2022 alone, a record $195.1 billion USD (4) was deployed by these firms to acquire public companies and convert them back to private. Investopedia has a great article on the pros and cons of these transactions, here: https://www.investopedia.com/articles/stocks/08/public-companies-privatize-go-private.asp(5)

Additionally, some companies return to private – or never go public at all – due to additional strategic benefits for the firm (6). Private companies in the U.S. are not required to submit SEC filing regulations and save money on compliance and reporting costs. These companies aren’t constantly facing public scrutiny, allowing them to focus on the long-term growth of the firm rather than meeting quarterly expectations to keep shareholders happy in the near term.

An example of this would be Subway, a company that has decided to remain private throughout its existence. Why would one of the fastest growing-restaurant chains in history (7) want to remain private? First, they didn’t need to go public. They didn’t need to raise additional funds and stuck with their franchising business model that allowed them to expand quickly without needing to raise large amounts of excess capital. Second, they didn’t want to constantly answer to shareholders. They found that the goals between franchisees and shareholders may not always align and didn’t want to sacrifice their long-term growth strategy to satisfy the public (8).

Profitability of Publics

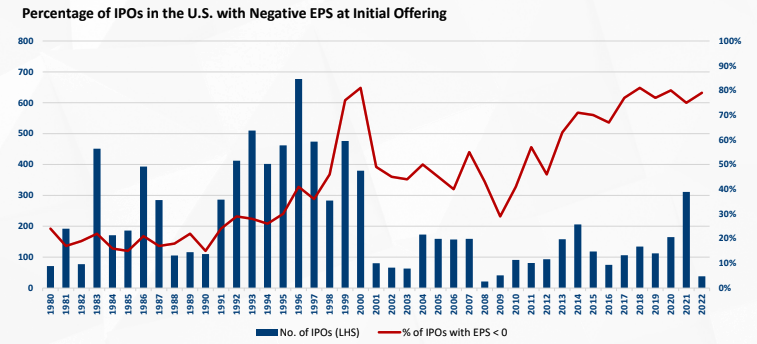

Another important trend pertaining to the public markets are the profitability and quality of companies going public. In 1990, the share of companies in the U.S. that were profitable at the time of their initial public offering (IPO) was about 85% (9). At the time, this made sense. ‘Going public’ was the ultimate end goal for shareholders to monetize their investment and so companies were groomed until they looked picture perfect in terms of profitability before being unveiled to the public.

In 2022, just 21% of companies going public were profitable (9). Thus, only 1 in every 5 companies being offered to investors have proven their ability to turn a profit!

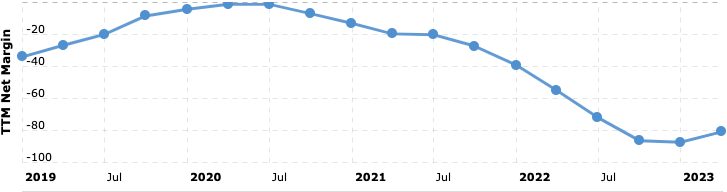

Take a company like Beyond Meat for example. They are an innovative, plant-based synthetic ‘meat’ maker that launched their IPO in 2019. Shares of their company surged 163% in one of the largest initial public offerings in the U.S in almost 20 years (10). The problem? Up until that point, Beyond Meat had never made a profit. Four years later, they have still never made a profit. They actually lost US$366 million last year and have been negative every year since their IPO (11). Other public companies like Uber, Lyft, and Snap share similar storylines (12).

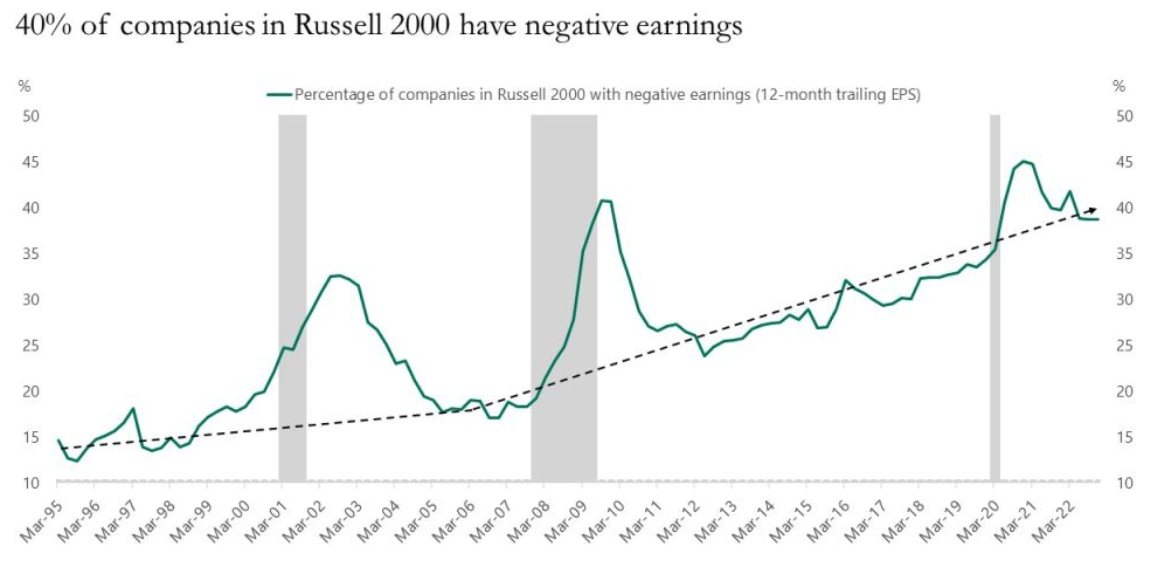

Additionally, we can zoom out and look at a broad index of publicly traded companies to analyze levels of profitability in the public markets. The Russell 2000 Index is made up of 2,000 publicly traded small and mid-sized companies in the United States. In 1990, 15% of companies in the Russell 2000 had negative earnings. Today? Around 40% of companies on the index were not able to turn a profit during good economic times (13).

Public companies used to be where crown jewel, stable companies were brought to market and the private markets were where speculative risk was taken. Now, we must be aware of companies who may go public to raise money when they are desperate to enrich founders, or keep rolling the dice on their high risk, no profit, business ventures.

Flipping Between Sexy and Boring

Historically, public equity used to be boring and private equity was riskier. Now, public markets can carry elements of risk such as chasing unicorns and trying to find the “next big thing”. Think of the “sexy” stocks in the marijuana, biotech and crypto-currency space that investors rushed to in recent years, much like racing to the store for lottery tickets. So far this year, it is Artificial Intelligence stocks that are all the rage.

On the other hand, many private equities are now focused on the boring and stable companies that produce solid cash flows. By identifying companies in resilient sectors with proven historical track record of sound financial performance, they can acquire these firms and help them reach new heights.

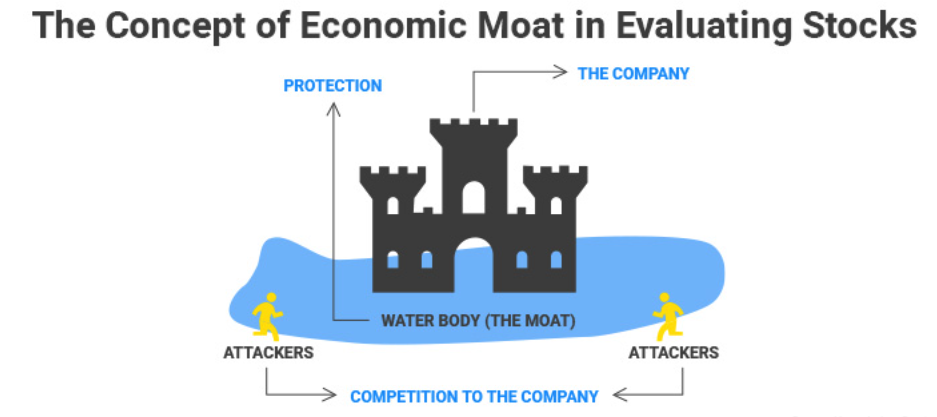

Warren Buffett popularized the term “economic moat” to describe a business that can maintain competitive advantages in their industry and protect their long-term profits and market share. The analogy relates to a medieval castle, where the moat protects those inside the fortress and their riches (the company) from outsiders (their competitors). Buffet used public equity to find these long-term value companies. Now, these companies are being found in the private space.

For example, a private equity product we invest in recently acquired a leading commercial flooring installation company last year. The commercial flooring industry is a $36B market that realizes ~4-6% growth per year. The company itself has a very strong track record of growth as well, growing by an average of ~8% over 4 years through 2019, and ~15% through 2020. Although the industry may not be the flashiest, their financial performance - driven by predictable flooring replacement cycles – is a good fit for our pension-style portfolio.

Another example of a private company in which we invest within the Tactical Pool that exhibits a strong moat is the largest provider of laundry services to the specialty healthcare market in the United States. They provide linen, patient gowns, scrubs, and safety equipment to medical facilities and provide other services like cleaning and disinfection. The company has over 70 plants nationwide and serves over 26,000 customer locations. They also have the largest portion of market share in the industry – over 5x the size of the next biggest competitor.

These are companies and industries that may not seem the most attractive by nature. But there is certainly a beauty in the boringness when they coincide with stable and consistent cash flows for investors.

How This Impacts You

Despite this elaborate article in favour of private equity, it is important to note that we still believe in public markets and see our tactical strategy (buying low, selling high) as the cornerstone of our core strategy. As previously mentioned, some of the world’s greatest and most profitable companies – Amazon, Alphabet (Google), Microsoft, RBC – are all traded publicly.

Since the launch of our pooled funds allowed us to participate in private equity offerings, we have been allocating to these opportunities. At the time of this writing, Private Equity represents ~6.5% of the Tactical Pool and 21.4% of our growth portfolio. They are a way in which we can invest in solid companies with sound financials that provide consistent cash flows and returns over the long-term. They also have low correlation to public equities and are a great diversifier when public markets are volatile and turbulent.

As your financial quarterback, our job is to identify and understand the evolution of investment markets and leverage the tools available to us to help you meet your long-term objectives. We hope that this article has helped you gain a better understand on this piece of your diversified investment portfolio.

We thank you for your continued trust in our stewardship and remain available to you to discuss the specifics of your accounts.

References

- https://finance.yahoo.com/quote/AMZN/key-statistics/

- https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

- https://data.worldbank.org/indicator/CM.MKT.LDOM.NO.

- https://pitchbook.com/news/articles/pe-buyout-take-private-outlook.

- https://www.investopedia.com/articles/stocks/08/public-companies-privatize-go-private.asp

- https://www.investopedia.com/articles/stocks/08/public-companies-privatize-go-private.asp

- https://web.archive.org/web/20170810173615/https://www.forbes.com/pictures/feji45iged/1-subway/#7b997c2745f4

- https://www.nrn.com/blog/why-subway-never-went-public

- Ritter, JR, 2023. Initial Public Offerings: Updated Statistics, Gainesville: Warrington College of Business, University of Florida.

- https://www.marketwatch.com/story/beyond-meat-soars-163-in-biggest-popping-us-ipo-since-2000-2019-05-02

- https://www.businessinsider.com/beyond-meat-vegan-plant-based-fake-meat-inflation-prices-restaurants-2023-2

- https://money.usnews.com/investing/stock-market-news/slideshows/famous-public-companies-that-still-arent-profitable

- https://apolloacademy.com/40-of-companies-in-russell-2000-have-negative-earnings/

- Hits: 8968