Issue #47 – “The return of Irrational Exuberance”

“We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

– Alan Greenspan

Interesting Links from Around the Web:

Investing : Mapping Stock Market Valuations : Star Capital

Economics : Future Demographics of Labour : ThePost

Other : Secrets of Body Language : History Channel

Investing : Mapping Stock Market Valuations : Star Capital

Economics : Future Demographics of Labour : ThePost

Other : Secrets of Body Language : History Channel

Potential trade wars between United States, Mexico, Germany and China, France’s potential exit from the Eurozone, and a President who spitefully blackballs the media are not typical headlines when the stock market reaches all-time highs. With plenty of reasons to be nervous about the markets, why are stock prices rising? In this issue of Innova Market Insights, we dive into some of the possible explanations for this irrational exuberance.

The Why

The party perceived by many as ‘pro-business’ (i.e. the Republicans), controls the house, the senate, and the presidency for the first time since 2006. This fact alone accounts for the stock market’s initial enthusiastic reaction to Mr. Trump’s election. With political gridlock in Washington forestalled for at least 2 years, there is hope that much needed infrastructure projects will receive funding and pipeline projects approval.

Furthermore, Trump ran on a platform of tax reform specifically targeted at bringing corporate cash piles back to US coffers from offshore accounts with the hopes of seeing these dollars reinvested into the economy. The “Buy/Hire American” policies referenced in last night’s joint session of Congress address could also result in boosts to economic activity.

Should all of these stimulus measures take effect, the US real GDP growth rates could reach 3% for the first time since 20051, which bodes well for US firms.

In anticipation of increased economic activity in the US, the Federal Reserve has begun increasing its base lending rate. Subsequently, this increase triggered a rise in general interest rates, making investments in bonds and fixed-income products unattractive as they lose value in times of increasing interest rates. For these reasons, investors are fleeing bonds. For many, stocks and bonds make up the bulk of their investable assets; as such, if you intend to sell one of the two it is typically to buy the other. As ‘new’ buyers move into the stock market, prices rise.

This scenario is particularly true regarding pension funds. Generally these funds have to earn a specific rate of return to remain solvent and grow at the speed required to meet their future payout obligations. For example, if an employee sets aside $10,000 per year for 30 years toward their defined benefit pension then retires at age 60 and starts to draw $50,000 per year until approximately age 90, the pension plan must earn close to 6% per year, not accounting for inflation.

When interest rates are at the 6% mark, this target is of little concern. However, when rates hover around the 3% mark as they are today, pension plan managers must rely on stocks to make up the difference in required returns. As such, they increase their exposure to stocks in hopes of reaching the required rate of return for their plans. To finance this increased exposure to higher risk vehicles managers sell bonds, consequently leading to a drop in the price of bonds and an increase in the price of stocks. As we have seen since Mr. Trump’s election, pension-friendly stocks like IBM, Exxon Mobil, Procter & Gamble, have benefited from the sharp sell-off of bonds and considerable in-flows of cash, causing many of these stocks to trade well above their historical multiples.

In addition to forcing investors up the risk scale, low interest rates also fuel speculation. Conventional leverage, or borrowing money to invest, works under a simple principle: if investment interest outweighs borrowing interest, you are ahead of the game. With interest rates at all-time lows, speculators and risk-takers are all too happy to purchase additional stocks with the bank’s money, gambling on their future growth. For example, an investor who would typically be able to purchase $10,000 worth of stocks may borrow an additional $100,000 from the bank using their home’s inflated value as collateral and then buy ten times the amount of shares they were going to. Subsequently the increased purchasing volume significantly impacts stock prices. Just as in any free market, when there are more buyers than sellers, prices go up.

Our concerns

Let me first state that I have nothing against growing stock markets – in fact, I love seeing them! That being said, I grow concerned when there is disconnect between stock prices and profits. I don’t mind paying more for a company as long as its profits are growing, but when future profits face headwinds and stock prices keep going up, I get worried. Since 2012, stock price growth has considerably outpaced the growth of profit and return on equity2. According to historical price-to-earnings ratios, a measure of value, the S&P500 as a whole is in bubble territory. In other words, investors are paying more and getting less.

For these valuations to be justifiable we need a flat stock market combined with unprecedented profit growth over the next several years and everything has to go just-right! Given the tumultuous first thirty days of the US presidency, I wouldn’t consider that a sure bet. So far Mr. Trump has been very light on specifics and his policies are far from predictable. Casual comments on blunt force policies like sweeping border taxes can have substantial unintended consequences and according to economic theory, negatively impact growth.

Given the high valuations and significant uncertainty, who is buying these stocks and pushing prices up? This question turns my worry to fear. According to an article published this week by JP Morgan Chase3, it is retail and not professional investors who are behind the recent run-up. Data shows that formerly risk-averse “mom and pop” investors are buying into the market while pension fund managers and institutions are quietly taking profits off the table. Simply stated, Main Street is buying while Wall Street is selling.

To compound matters, Main Street is buying low-fee index funds which are built to buy more of the stocks that have recently gone up in value instead of analyzing a company’s fundamentals. By following this strategy, they are buying stocks after they have already gone up. Every time new money flows into these types of funds, the shares that are already over-valued are pushed up even higher. This is the epitome of “Buying High” and sadly, has been the curse of the retail investor throughout history.

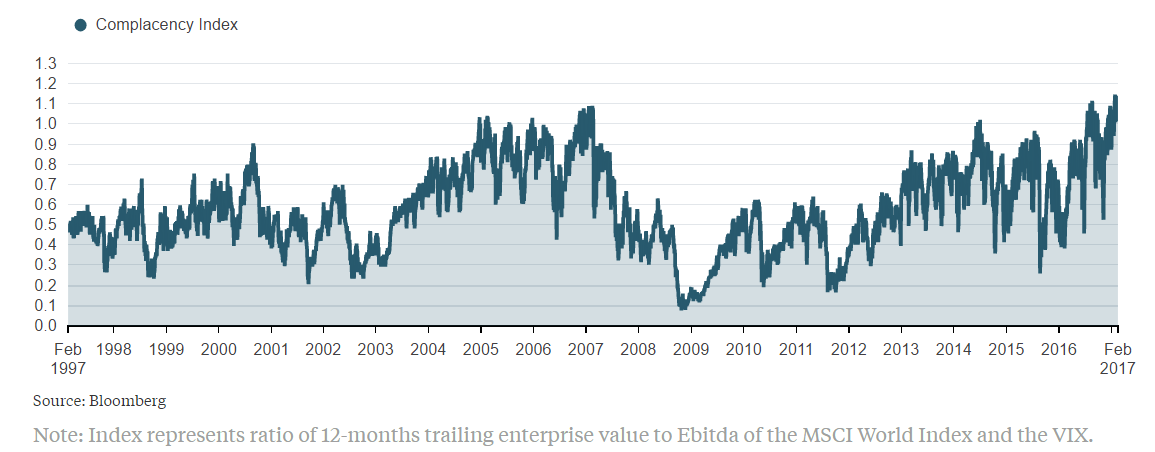

Perhaps the chart that best exemplifies the irrational exuberance of today’s market is the “Complacency Index” 4. This chart seeks to compare the value of a company and its profits versus the stock price and the VIX, nicknamed the “Fear Index”.

High stock prices combined with a low Fear Index indicate investor complacency as they buy without carefully analyzing what they are paying and the risks associated to the purchase.

At present, this “Complacency Index” has reached its highest point in at least twenty years. Previously, it only maintained such high levels twice in the indexes history; the lead up to the dot-com bubble and the 2008 crash.

Full size image at: https://www.bloomberg.com/gadfly/articles/2017-02-17/stock-investors-breathtaking-complacency

What are we doing about it?

Given this reality, our first step was to lower overall exposure to the stock market for most clients. With an over-inflated stock market and the threat of rising interest rates, cash is king. Since mid-2015 we have been building cash savings for clients in an effort to protect the substantial gains that have been earned in the past 7 years, and continue to do so.

For investors comfortable with risk in their portfolios, we’ve added to our existing emerging markets holdings, one of the few bastions where we can get appropriate value for your dollar. The stock markets in these areas have gone through corrections in recent years and valuations appear attractive. We have written about this opportunity in the past (Issue #31 & #40) and have reaped the benefits of this allocation. We continue to believe emerging markets are the best long-term buying opportunity on the market.

The age old adage “Buy Low, Sell High” is easy to say and to profess to follow. In practice however, it takes tremendous discipline to reduce your exposure to a rising market and sit on the side-lines while fresh highs are hit daily. Our tactical asset allocation strategy aims to follow the lessons of the markets by reducing our exposure to the stock market when we deem it to be expensive or over-valuated, as is the case now. Although doing so will mean underperforming if the markets continue their wild ride, we will be well positioned when they come back down to reality and revert to their historical averages. This may occur in the next 2 months, or in the next 20, but when the opportunity presents itself we will be ready to buy good quality companies with cash on hand.

Jean-François Démoré

CIM, CFP, MBA, HBCCS

1. US Real GDP Growth by Year: http://www.multpl.com/us-real-gdp-growth-rate/table/by-year

2. S&P500 Multiples: http://www.multpl.com/table

3. Bullish mom and pop behind U.S. stock market’s record run: http:/www.theglobeandmail.com/globe-investor/investment-ideas/bullish-mom-and-pop-behind-us-stock-markets-record-run/article34158396/

4. Stock Investors’ Breathtaking Complacency: https://www.bloomberg.com/gadfly/articles/2017-02-17/stock-investors-breathtaking-complacency

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

- Hits: 6258