Issue #55 - The Year of the Bubble

In January 2017, news pundits and investment analysts blasted the airwaves with concerns over the stock market bubble, the bond market bubble and, loudest of all, the Canadian real estate bubble. Fast forward a few months and all of these bubbles have been eclipsed by perhaps the fastest appreciating bubble humans have ever witnessed – the Bitcoin Bubble.

MARKET DATA

|

|

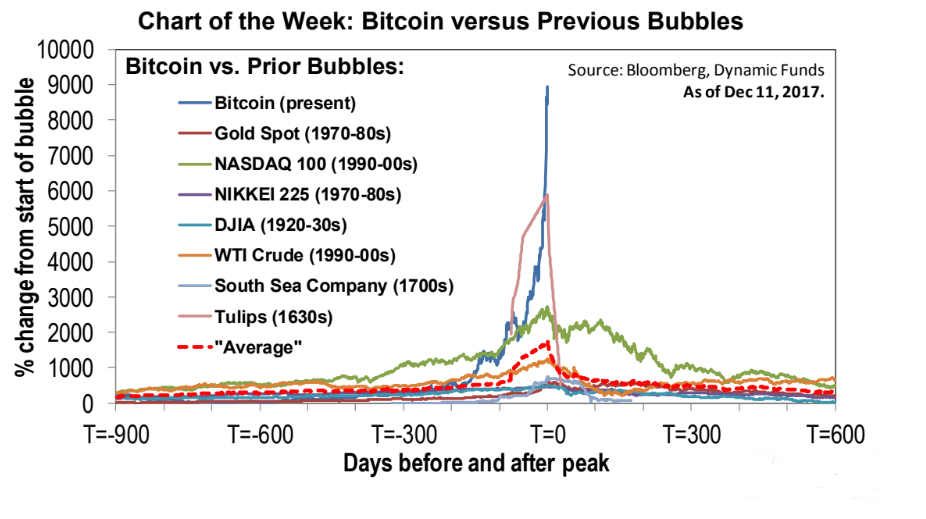

As the following chart shows, only the great Tulip bubble of the 1600s comes even close to the rapid appreciation seen this year in the world of cryptocurrencies.

As of the time of writing, Bitcoin just underwent its fourth drop greater than 30% this calendar year. Needless to say, betting in this market is not for the faint of heart. We continue to feel that the block-chain technology underpinning Bitcoin will one-day be truly transformative and that the crypto-currency Ethereum is best positioned to deploy the technology to its fullest potential. That being said, until crypto-currency can actually be used to buy goods and governments show that they are willing to allow the currency to thrive, or at least get out of its way, we view any hard-earned dollars placed in this market as being as risky as going to a casino.

As of the time of writing, Bitcoin just underwent its fourth drop greater than 30% this calendar year. Needless to say, betting in this market is not for the faint of heart. We continue to feel that the block-chain technology underpinning Bitcoin will one-day be truly transformative and that the crypto-currency Ethereum is best positioned to deploy the technology to its fullest potential. That being said, until crypto-currency can actually be used to buy goods and governments show that they are willing to allow the currency to thrive, or at least get out of its way, we view any hard-earned dollars placed in this market as being as risky as going to a casino.

Away from the world of speculation, the world stock markets have produced relatively impressive results. The tech-heavy NASDAQ exchange in New York closed out the year +19.9% (when adjusted for the Canadian dollar), benefitting from substantial gains in the so-called ‘FAANG’ stocks of Facebook, Amazon, Apple, NetFlix, and Google – all of which produced double-digit returns in 2017. The more diversified US market index, the S&P500, generated strong returns and closed 2017 at +11.7% while the markets in other developed economies in Europe and Asia, featured in the MSCI World Index, also performed well by adding +12.3% to loonie-based investors.

Emerging markets proved to be the place to be for Canadian investors, with the MSCI Emerging Markets Index returning a whopping +25.7%.

Back home, the Toronto Stock Exchange closed 2017 up +6%, dragged down in large part by the underperformance of energy stocks. Base metal and material stocks saw a resurgence as the world economic engine began firing in cohesion for the first time in over a decade with almost all economies showing sustained month-over-month GDP growth.

With this in mind our relatively new Governor of the Bank of Canada, Stephen Poloz, saw fit to raise interest rates for the first time in over seven years. In large part, this increase was seen as an attempt to try and curb the growing Canadian real estate bubble. Although it did take some of the steam out of Canada’s two hottest markets, Toronto and Vancouver, it sent bond prices tumbling and the Canadian dollar soaring. Following yet another rate hike in September, the FTSE TMX Canada Universe Bond Index closed the year +2.5%, while the Canadian dollar had its strongest year since 2009, up nearly 7%.

All in all, it was not a great year for Canadian investors but an excellent one for globally diversified portfolios.

Performance

We are pleased to report that our preference for international stocks over a Canadian focused balanced portfolio was a beneficial one. In particular, those clients who followed our recommendations for overweight allocations to emerging markets benefitted from one of the top performing major asset classes.

In the fixed-income category, we opted for the TD Income Advantage Portfolio which makes use of equities and derivatives to offset the risks of rising interest rates. This strategy proved fruitful as the position outperformed the broad Canadian bond market by +0.74 % (net +3.24%). Complimenting this core holding was the Pimco Monthly Income Fund, a satellite bond fund that finished at the top of its category by closing out the year +6.89%.

In the Canadian equity space, we opted for two exchange traded funds (ETFs): the BMO Low Volatility Cdn Equity (+11.06%) and the BMO Covered Call Canadian Banks ETFs (+11.52%). Both of these funds outperformed the Toronto Stock Market as a whole (+6%).

Our global equities are managed by two high conviction stock pickers, Tye Bousada of Edgepoint and Bill Kanko of CI Black Creek. Despite being a balanced fund aimed at moderate growth, the Edgepoint position closed the year +13.38%, while CI’s Black Creek Global Leaders dominated its category and posted a +21.04% return for 2017.

Our biggest winner of all however was the overweight exposure to the emerging markets space. Our chosen allocation was Philip Langham’s RBC Emerging Markets Fund which returned investors +27.13% this year.

Our biggest mistake this year was our defensiveness. Following the Trump election, we took a more conservative stance in portfolios which acted as a drag on performance. In particular, the Cambridge Asset Allocation fund returned a meager +3.17% for the year due in large part to a heavy cash position to lower risk.

Despite this a more conservative approach for the year, most of our clients will close out 2017 with a return in the 5-10% range, depending on personal level of risk. Overall, we feel that this is an excellent rate of return for a defensive portfolio given rising interest rates.

Looking forward to 2018

Despite being the ninth consecutive year of positive returns for US investors, stock market valuations seem more reasonable now than they did last year thanks to substantial profits earned by corporate America and the pending Trump tax cuts. This has helped ease our ‘bubble’ concerns, but not alleviated them completely.

The economic engines of the world are firing in synch for the first time since 2007. All 45 countries tracked by the OECD are on track to grow this year and more than 2/3 of them predicted to have accelerated growth. Real GDP growth in Canada has grown year-over-year by a full percentage point up to 3.4% (Oct 31st) while unemployment has dropped to 5.9% (Nov 30th), which is considered full employment. Despite this, core inflation remains subdued and actually fell to 1.3% year-over-year due in large part to the strengthening Canadian dollar, flat oil prices, and falling natural gas prices.

Although the tightening labour market has not led to rising wages, it has had a noticeable impact on consumer confidence (121 in 2017 vs 104 in 2016) and the purchasing managers index (62 in 2017 vs 49 in 2016), both of which improved considerably year-over-year.

The story is much the same for our neighbours to the South where very low unemployment rates and strong consumer confidence have pushed up retail sales. Despite similar stagnant wage growth, the Federal Reserve has now turned hawkish and is raising rates. Surprisingly, this has not helped the struggling US dollar which posted a drop of almost 10%, its worst year since 2003. In large part, this exodus of capital was caused by profit takers in the rising US stock market and balance sheet concerns over the US’ ability to meet future debts given the massive spending bill pushed through by Donald Trump.

Although a curious time for such a substantial stimulus package, the combination of lowered tax rates and business investment incentives should keep the US gravy train running at full-speed for at least the foreseeable future. In particular, the ability for companies to fully expense investments in new manufacturing on US soil, as opposed to having to depreciate it over several years, might tilt the scale in favour of ‘Made in America’. Unfortunately for the blue-collar workers who voted for Mr. Trump hoping to bring jobs back to rural America, today’s manufacturing plants are not the job-creating engines they once were. With their high-tech robotics and GPS enabled self-driving forklifts the economic activities generated by these new plants are more likely to benefit engineers and specialist firms rather than low-skilled workers.

What a difference a year can make! We entered 2017 very concerned about the direction of the markets with a strong preference toward defensive positions. With the economic engines of the world firing together, we see no major impediments to sustained economic growth, and along with it, corporate profits. That being said, valuations in the US and Canada are by no means attractive and so we will continue to maintain cash positions in hopes of buying when bargains present themselves. We re-orientated the portfolio for growth in early November with the inclusion of the TD US Mid-Cap Growth instead of the RBC QUBE Global Low Volatility position due to more attractive valuations. We will continue to monitor the market for these types of opportunities.

We expect the Canadian market to perform much better this year on the backs of rising commodity prices, as long as the NAFTA trade talks do not fall through, while hoping for positive returns of any kind out of our bond and fixed income positions in the face of rising interest rates.

Innova Wealth Management

It was another busy year for the Innova team as we undertook a seismic shift in our investment model. We moved to a transparent fee-for-service platform which lowered the after-tax cost of our services by 15-40% for many clients. The inclusion of new products permitted by our move to Aligned Capital Partners Inc. contributed significantly to the outperformance noted above.

Amidst the changes to our investment model, our rapid growth continued and we reached an important milestone this year: $50 million dollars of investments under management! This landmark is truly a testament to our client-first philosophy and we cannot say Thank You enough for your continued support and your referrals of friends and family to our unique 360° wealth building strategies. We look forward to building on this success with you in 2018.

We would like to take this opportunity to Thank You for another great year and to wish you the very best in 2018!

Jean-François Démoré

CIM, CFP, MBA, HBCCS

Sources:

Market Data Provided by TD Bank’s “Weekly Market Report” PDF and www.Bloomberg.com/markets

Performance figures of major allocations as at Dec 31st, 2017

Individual Accounts

|

Fund Name |

Category |

Risk Level |

2017 |

2016 |

1-Month |

3-Month |

6-Month |

3-Year |

5-Year |

10-Year |

Inception |

|

Cdn Bond |

Low |

+3.24% |

+4.63% |

-0.25% |

2.34% |

1.46% |

2.97% |

4.11% |

4.76% |

4.74% |

|

|

Divers. Income |

Low-Med |

+6.89% |

+7.59% |

-0.12% |

0.44% |

1.87% |

6.89% |

6.21% |

No data |

11.11% |

|

|

Global Growth |

Low-Med |

+13.38% |

+12.82% |

-0.87% |

4.02% |

6.06% |

12.14% |

16.83% |

No data |

15.18% |

|

|

Cdn Balanced |

Low-Med |

+3.17% |

+7.73% |

-0.98% |

1.62% |

1.65% |

5.35% |

9.34% |

No data |

6.86% |

|

| BMO Low Volatility Cdn ETF |

Cdn Equity |

Medium |

+11.06% |

+13.05% |

-0.42% |

3.50% |

4.51% |

8.85% |

14.85% |

No data |

- |

| BMO Covered Call Cdn Banks ETF |

Cdn Equity |

Medium |

+11.52% |

+25.26% |

1.23% |

5.10% |

9.84% |

10.23% |

11.73% |

No data |

- |

|

Global Equity |

Medium |

+21.04% |

+8.68% |

-1.75% |

3.36% |

7.86% |

17.10% |

19.04% |

10.93% |

10.28% |

|

|

Emerg. Markets |

High |

+27.13% |

+2.18% |

1.60% |

7.68% |

10.29% |

12.00% |

11.44% |

No data |

8.80% |

Group Plans

|

Fund Name |

Category |

Risk Level |

YTD |

2016 |

1-Month |

3-Month |

6-Month |

3-Year |

5-Year |

10-Year |

Inception |

|

Global Balanced |

Low-Med |

+9.12% |

+0.42% |

-1.02% |

2.41% |

3.70% |

5.18% |

6.90% |

No data |

4.96% |

|

|

Global Balanced |

Low-Med |

+6.00% |

+3.79% |

-0.04% |

3.26% |

3.21% |

4.44% |

6.38% |

No data |

7.27% |

All performance is net of all management expenses ratios (MER) but before Fee-For-Service advisor compensation if applicable. Source: Morningstar.ca & TD Wealth

Innova Wealth Management is a trade name of Aligned Capital Partners Inc. (ACPI). Jean-François Démoré, as an agent of Innova Wealth Management/ACPI is registered to provide investment advice in the provinces of Ontario, Quebec, and British Columbia. Investment products are provided by ACPI, a member of the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and the Canadian Investor Protection Fund (www.cipf.ca). All non-securities related business conducted by J-F Demore as a representative of Innova Wealth Builders is not covered by the Canadian Investor Protection Fund and is not under the supervision of ACPI.

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

- Hits: 5957