Issue #62 - Pick a winner!

Let’s play a game shall we? I will describe two companies in detail while hiding their names and you tell me which of the two you would invest in! And......Begin!

Business Model

Company A: Design, Ecosystem, and Outsourcing

Company A’s business model is focused on reinventing itself every year with new designs at ever increasing price points to obtain the highest potential net profits out of its established, highly loyal customer base. A true marketing and advertising engine, the loyalty of its customer base is nurtured through marketing ‘culture and brand identity’ and a suite of periphery devices and services that are highly interconnected. With the exception of design, the manufacturing process is almost entirely outsourced to developing countries. From a performance standpoint, the flagship device is middle of the pack compared to its peers, but commands an almost +40% price premium due to the loyalty of its customer base. Despite having recently dropped from 2nd place (behind Company B) to 3rd (behind a Chinese newcomer) in terms of units shipped and market share, Company A still managed to take in more than 50% of total revenues in the declining global smartphone market.

Company B: Vertical Integration & Product Volume

Company B has followed a more traditional model focused on manufacturing and vertical integration. Along with being the market leader in number of units sold and market share of Smartphones, it is also the world’s largest chip maker and LCD/OLED manufacturer. It is also the market leader in home electronics and in the top 5 for home appliances. In large part, Company B has achieved this success through automated product lines that deliver high quality products at competitive prices.

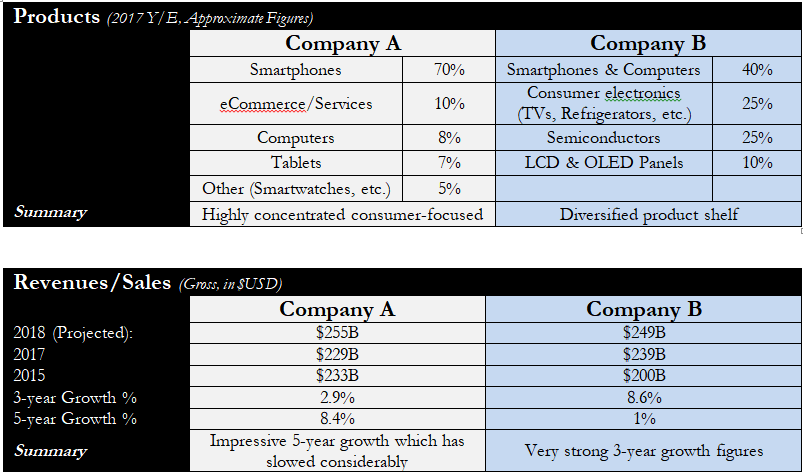

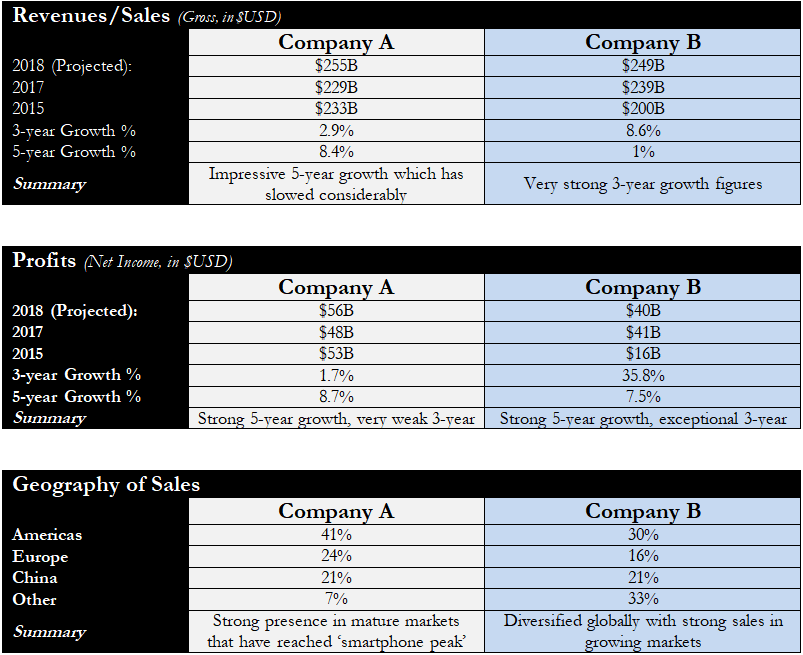

Here are the numbers:

Summary

Company A is laser-focused on high-end smartphones in North America and on the peripheral ecosystem it has built around this product. As that market matures, total market size is expected to continue to decline . To combat this, Company A managed to substantially increase the price on their flagship model despite adding no real value. Nonetheless the increase was well tolerated by its fanatically loyal customer base which allowed Company A to reach all-time profits.

Conversely, Company B shipped fewer smartphones in 2018 as it lost market share to up and coming Chinese manufacturers. Fortunately, its diversified product line up more than compensated, helping Company B reach all-time profits in Q1 2018.

Company A is located in a politically volatile country whose smartphone market is believed to have hit its ‘peak’, while Company B is located near the world’s two largest smartphone markets by volume, and on the world’s most defended border.

From a valuation standpoint, investors can buy Company B for half the price as Company A. Despite this, Company A’s stock price reached new highs and recently making it the world’s first $1B company by market capitalization, which is calculated by multiplying the total number of shares by its share price.

Armed with this information – would you buy Company A or Company B? Please let us know your thoughts by email!

Sources

All Financial data from Morningstar.ca , converted from South Korean Won to USD on December 1st annually.

1. Samsung vs Apple: https://www.investopedia.com/articles/markets/110315/samsung-vs-apple-comparing-business-models.asp

2. Huawei Overtakes Apple in Smartphone Shipments: https://techcrunch.com/2018/08/01/huawei-overtakes-apple-in-smartphone-shipments/

3. Samsung, now the world’s largest chipmaker https://techcrunch.com/2018/04/05/samsung-now-the-worlds-largest-chipmaker-forecasts-record-q1-profit/

4. Global Smartphone Market in Decline https://www.counterpointresearch.com/global-smartphone-market-declined-yoy-second-successive-quarter-q1-2018/

Innova Wealth Management is a trade name of Aligned Capital Partners Inc. (ACPI). Jean-François Démoré, as an agent of Innova Wealth Management/ACPI is registered to provide investment advice in the provinces of Ontario, Quebec, and British Columbia. Investment products are provided by ACPI, a member of the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and the Canadian Investor Protection Fund (www.cipf.ca). All non-securities related business conducted by J-F Demore as a representative of Innova Wealth Builders is not covered by the Canadian Investor Protection Fund and is not under the supervision of ACPI.

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

- Hits: 5486