Echoes of the Dot Com Bubble Burst

Wow! What a whirlwind these past few weeks.

Although the Blue Wave did not materialize, it would appear that we are, most likely, heading to a Democrat controlled White House come 2021. Despite the contentious election, a divided house and senate, and a substantial rise in Covid cases, the markets have crept up to new all-time highs.

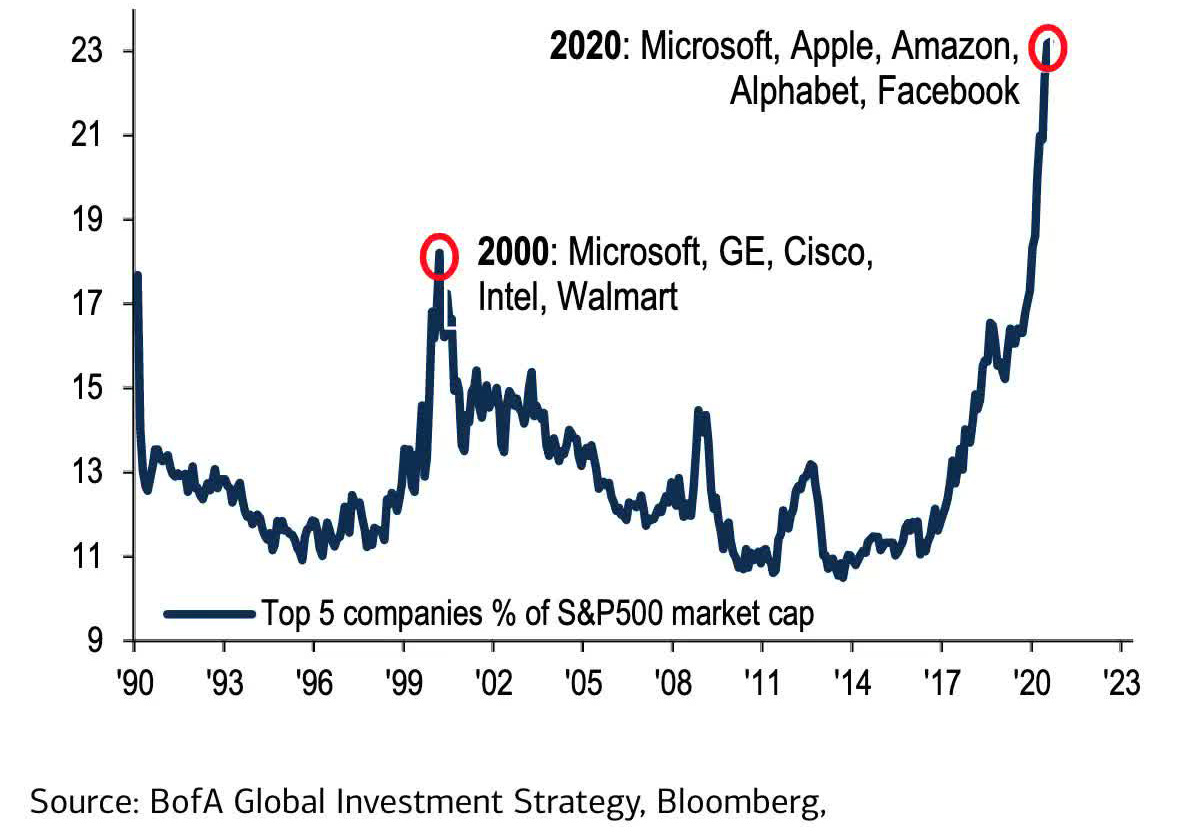

Like many of you, the meteoric rise in stock prices has left us with more questions than answers. As of November 30th, the Toronto Stock Exchange finally returned to posting positive returns year to date (YTD) with a whopping +2.0% on the year. The S&P500 is also now up 12.6% by riding the highs of the ‘Big 5’ tech stocks (Facebook, Amazon, Apple, Google, and Microsoft), which now make up a staggering 25% of the total US stock market.

As we have discussed in the past, the once diversified stock index has grown increasingly concentrated, mirroring the disparity between Main Street and Wall Street south of our border. In fact, at no other time in history have five stocks dominated the S&P500 more than these five do today.

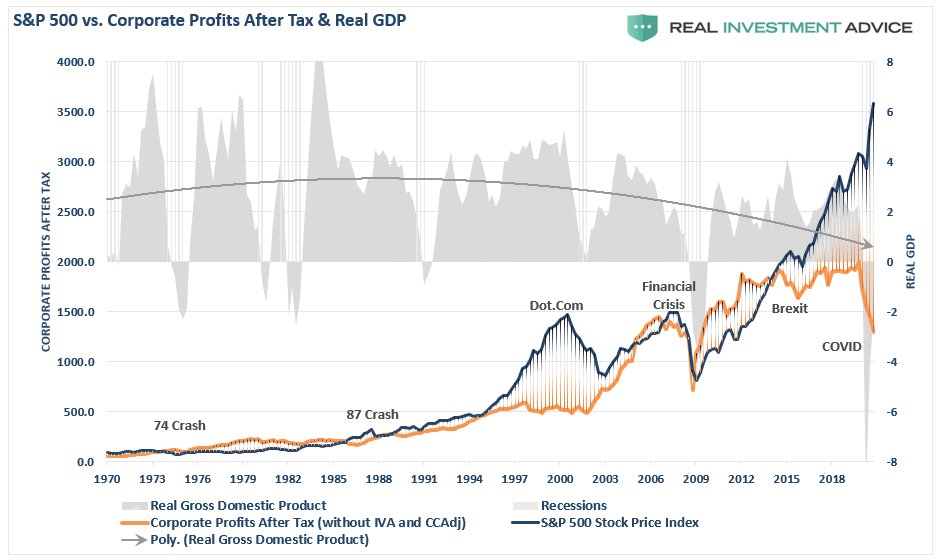

The last time such a concentration occurred was near the height of the DotCom bubble. As we addressed in our Innova Market Insights (IMI) from September, ‘The Great Divide’, we continue to feel that this market is ripe for correction based on flawed fundamentals. Historically, there exists a clear correlation between stock prices and company profits, one that has ended poorly for investors whenever this correlation fails. As indicated below, the last such disconnect occurred during the DotCom bubble.

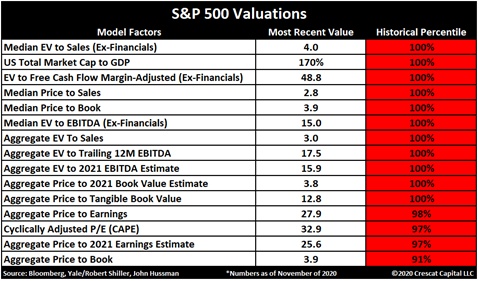

As we got caught up in the exuberance of a Covid vaccine (please help me get these kids out of the house!!!), these following stock market metrics have given us cause for pause.

In non-accounting speak, this chart shows us that by almost all valuation metrics, stocks at their highest of all-time (100%) or near to it when compared to historical norms. These high valuations directly correlate to lower potential returns for investors. According to the highly respected Research Affiliates, they estimate expected returns for large-cap US stocks at 0.1% per year over the next decade1.

With most the Big 5 stocks paying a meagre dividend, this means that investors are hoping for one of two things:

- Even higher valuations to push their stocks up

- An explosive jump in profits to justify the eye-watering prices

Investing and hoping for higher valuations is akin to the Greater Fool theory, while any hopes of an explosive jump in profits rests firmly on the following premises:

- An effective vaccine will be available worldwide near term

- Everyone who lost their job in March will be welcomed back with open arms

- Consumer and business spending will recover in a V shape

Those who know our team know that we are fundamentally optimists, a required trait for most small business owners, and so we hope you will forgive our pessimism regarding these possibilities materializing within the next six months.

Even if Big Pharma can broadly administer an effective vaccine, we believe that the scars of Covid run deep and will deeply affect the psyche of everyone. We expect that of the 11 million unemployed Americans2 and 1.86 million unemployed Canadians3 who are fortunate enough to have jobs to go back to will likely keep the purse strings tight as they pay off the debts that often accompany long-term unemployment.

Further, we believe that although many will rush to well deserved vacations (did I mention needing to get these kids out of the house?), the travel industry will be fundamentally changed. Will retirees be interested in crowding cruise ships? Will parents feel safe waiting 30 minutes in line at Disney World? How many companies will approve travel budgets when Zoom has shown to be effective?

The travel and tourism industry represents 10.4% of the worldwide economy4. Given pre-Covid growth rates of 3.5%5 , the world economy does not have a lot of ‘excess slack’ to absorb such a significant stutter in its engine.

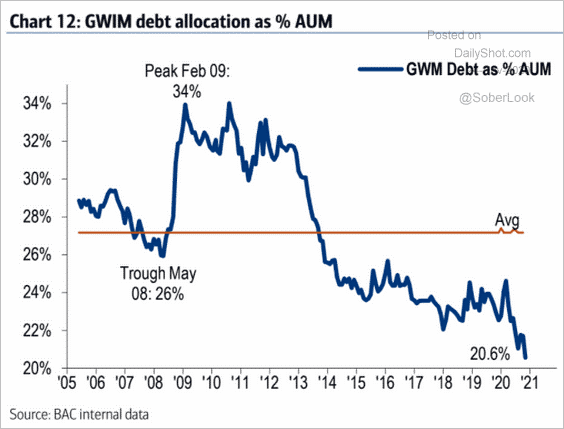

In large part, the sheer amount of money chasing stocks can be explained by TINA (There is no alternative). For most investors, they can only choose between stocks and bonds. With interest rates at rock-bottom, investors have overwhelmingly favoured stocks over bonds.

As indicated by Global Wealth & Investment Management (GWIM), bonds as a percentage of total investor allocations has not been lower for at least the past 15 years.

For these reasons, we continue to believe that selecting individual stocks will outperform the index as these dislocations work through the system. We also believe that our nimble positioning will maintain our ability to take advantage of the highs and lows of the market and help our clients enjoy a more stable ride. Lastly, we continue to make extensive use of alternative strategies such as real estate to reduce the volatility that our clients experience in their portfolios. These alternatives generate returns that are independent of the stock market and so have received large influxes of capital within our private pool.

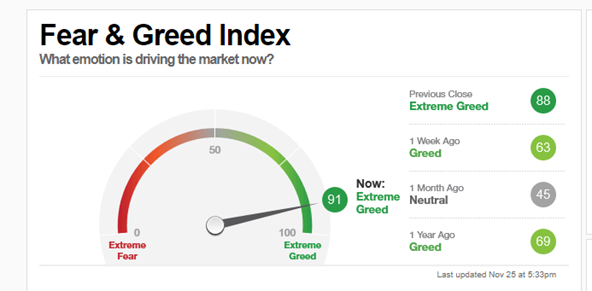

Lastly, I leave you with one more image and a quote from the Oracle of Omaha, Warren Buffett: “Be Fearful when Others are Greedy, and Greedy when others are Fearful.”

Thank you for your continued trust,

The Innova Wealth Team

Sources:

Many of the images from this month’s newsletter were sourced from this excellent Seeking Alpha article written by Danielle Park: https://seekingalpha.com/article/4391726-this-is-where-are

2. https://www.bls.gov/charts/employment-situation/civilian-unemployment.htm

3. https://tradingeconomics.com/canada/unemployed-persons

4. https://www.statista.com/statistics/1099933/travel-and-tourism-share-of-gdp/

Disclaimer:

Aligned Capital Partners Inc.(ACPI) is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Investment products are provided through ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Please contact Jean-François Démoré or Cliff Richardson, or visit https://invest.innovawealth.ca for additional information about the Innova Tactical Asset Fund. All non-securities related business conducted by Innova Wealth Partners is not as agent of ACPI. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Jean-François Démoré or Cliff Richardson.

Information has been compiled from sources believed to be reliable. All opinions expressed are as of the date of this publication and are subject to change without notice. Content is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The information contained does not constitute an offer or solicitation to buy or sell any investment fund, security or other product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI. For current performance information, please contact Innova Wealth Management of Aligned Capital Partners Inc. Important information about the Fund is contained in the offering memorandum which should be read carefully before investing.

- Hits: 10335