RESPs Explained: A Smart Way to Save for Your Child’s Education

What Every Parent Needs to Know About Building and Using an RESP

As the cost of post-secondary education continues to rise, many Canadian families are looking for tax-efficient ways to plan ahead. The Registered Education Savings Plan (RESP) has long been one of the most effective tools available to help fund a child’s future studies. It combines government incentives with tax-deferred investment growth and flexible withdrawal options, all within a structure that supports long-term planning.

RESP Overview

At its core, the RESP is an investment account that allows your savings to grow tax-deferred until your child begins post-secondary education. What makes it especially powerful is the government support it provides. The Canada Education Savings Grant (CESG) will match 20% of your annual contributions up to $2,500 - adding up to $500 per year, and up to a lifetime maximum of $7,200 per child. This is essentially a guaranteed 20% rate of return on eligible contributions!

Lower-income families may also be eligible for additional CESG, as well as the Canada Learning Bond (CLB), which can provide up to $2,000 without requiring any personal contributions at all.

You can contribute up to $50,000 per child, with no annual limit. That said, strategically planning contributions to maximize available grants is often an effective strategy. If you miss a year or get a late start, there’s also carry-forward room - you can contribute up to $5,000 in a single year to catch up on unused grant room and receive up to $1,000 in CESG for that year.

While any adult can open an RESP on behalf of a child (parents, grandparents, other relatives), the beneficiary must be a Canadian resident with a valid SIN.

Similar to a TFSA or RRSP, an RESP is an account type, not an investment itself. As such, RESPs can hold a wide variety of investments - including individual stocks, bonds, ETFs, mutual funds, GICs, or proprietary managed portfolios – allowing you to tailor the investment strategy based on risk tolerance, time horizon, and the age of the child.

Eligibility and Withdrawal Rules

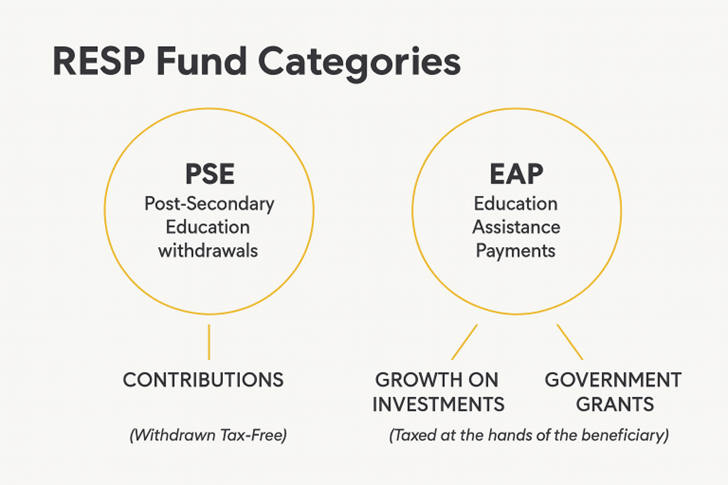

When it comes time to use the RESP, understanding how withdrawals are categorized is essential. There are the two types:

- Educational Assistance Payments (EAPs), which consist of the growth on the investments and the government grants

- Post-Secondary Education (PSE), which come from your original contributions

EAPs are considered taxable income for the student, not the contributor. This is often advantageous, as students typically have little to no income while in school - meaning EAPs can usually be withdrawn with little or no tax payable. Additionally, given contributions to the RESP are made with after-tax dollars, any PSE withdrawals are tax-free.

However, there are a few important rules to know. In the first 13 weeks of full-time enrollment, only $8,000 in EAP can be withdrawn. After that, the limit is removed as long as the student remains enrolled. If they’re attending part-time, the EAP limit is $4,000 per 13-week period. Because EAPs must be used for education, a rule of thumb is often to prioritize drawing them first, especially in years when the student’s income is low, to ensure no growth or grants are left unused in the account. Unused growth and grants in the account may result in additional tax and penalties, which we will cover shortly.

To access RESP funds, proof of enrollment (POE) from the institution is required. This documentation must include the following:

- Name of the Institution and/or Logo

- Institution's address

- Student's full name

- Name of the program

- Length of the program (i.e. how many years)

- Current year of program (ex: first year, second year, etc.)

Without this, the RESP provider cannot process a withdrawal, so it’s helpful to familiarize yourself with your child’s registrar and online portal.

Funds can be used for a wide range of eligible post-secondary programs, including universities, colleges, CEGEPs, trade schools, and technical institutes. Many international institutions also qualify, as long as they’re recognized by the CRA. It’s more flexible than most people think - RESPs can even be used for apprenticeships, provided they meet CRA criteria.

You can find the CRA’s master list of eligible programs, here.

What if my child doesn’t attend post-secondary?

Of course, not every child follows a traditional education path. Whether they start working right away, launch a business, or take time to explore their options, it’s important to understand how this may impact RESP planning.

If there are Educational Assistance Payments (EAPs) left in the RESP and no eligible beneficiary can use them, the consequences can be costly. Any remaining investment growth in the account becomes what’s known as an Accumulated Income Payment (AIP) - which is taxed at the contributor’s regular income rate plus an additional 20% penalty tax. On top of that, all unused CESG grants must be returned to the government. This is why careful planning is critical, particularly as a child approaches the age limit for RESP use or decides not to pursue post-secondary education at all.

Fortunately, there are ways to avoid these penalties and preserve the value of the RESP if a child decides not to attend post-secondary. One effective strategy for families with more than one child is opening a Family RESP, which allows multiple beneficiaries under a single plan. With a Family RESP, unused contributions, grants, and investment growth can often be shifted from one child to another without triggering taxes or forfeiting grants - making it a highly flexible option for families with multiple children.

If there are no other eligible beneficiaries, another option is to transfer up to $50,000 of investment growth from the RESP into your RRSP or a spousal RRSP, provided you have enough contribution room and the RESP has been open for at least 10 years. This allows the funds to continue growing on a tax-deferred basis and helps avoid the 20% AIP penalty. However, CESG grant amounts must still be repaid to the government if they go unused.

It is important to note, however, that RESPs can remain open for up to 35 years. If you think your child may pursue post-secondary education later on, this extended timeline offers meaningful flexibility and helps preserve access to the growth and government grants.

Summary

RESPs offer tremendous value - but like most financial tools, the benefit lies in how well they’re used. Contributing consistently to maximize grant money, choosing the right investments, and planning withdrawals in a tax-efficient way can make a meaningful difference. And with the right strategy, families can ensure they’re not just saving for school, but making the most of every dollar they’ve set aside for the future.

If you’d like to review your RESP strategy, ensure you’re optimizing government grants, discuss upcoming withdrawals, or explore options for a child who isn’t planning to pursue post-secondary education, we’d be happy to help.

References:

Canada Learning Bond – Government of Canada

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-education-savings-plans-resps/canada-education-savings-programs-cesp/canada-learning-bond.html

RESP Contribution Limits and Rules – TD Canada

https://www.td.com/ca/en/personal-banking/personal-investing/learn/resp-contribution-limit-rules-canada

Opening a Registered Education Savings Plan (RESP) – Government of Canada

https://www.canada.ca/en/services/benefits/education/education-savings/opening-plan.html

Registered Education Savings Plans (RESPs) – CRA Publication RC4092

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4092/registered-education-savings-plans-resps.html

Using an RESP for an Apprenticeship – Sun Life Financial

https://www.sunlife.ca/en/investments/resp/can-you-use-an-resp-for-an-apprenticeship

What Educational Institutions Are Eligible? – CEFI

https://www.cefi.ca/about-resps/using-your-resp/#:~:text=What%20Educational%20Institutions%20are%20eligible

Individual vs. Family RESP Plans – TD Canada

https://www.td.com/ca/en/personal-banking/personal-investing/learn/individual-or-family-resp#:~:text=In%20a%20family%20plan

Paying for Education – Government of Canada

https://www.canada.ca/en/services/benefits/education/education-savings/paying-education.html

This publication is for informational purposes only and shall not be construed to constitute any form of advice. The views expressed are those of the author alone. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

- Vues : 7035