The Great Rotation?

The Great Rotation?

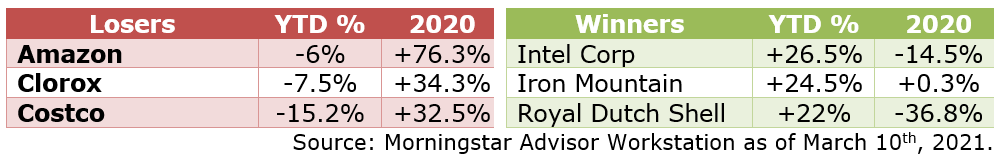

It’s been an interesting few weeks on the markets with the high-flyers of 2020 taking a few steps back and the browbeaten underperformers of Covid driving the market ever higher. The following is a quick snapshot of some of the market’s winners and losers so far this year, which may surprise you!

Amazon, Clorox and Costco all posting negative returns year-to-date? What’s going on, you might ask?

All three of those stocks were darlings in 2020, posting gains in excess of 30%! In our opinion, this recent pullback is part of a return to normalcy wherein actual company earnings and profits start to matter more than perception and emotion. As we have discussed many times before, stocks move up or down based on three things… Fear, Greed, and Profits! In this case, Fear and Greed pushed these stocks well above what we consider to be ‘fair value’ and so this recent ebb can be construed as the snap back to reality.

The impact of the pullback can be observed across all the markets and is considered a ‘rotation’ from speculative growth stocks (ex: Tesla) to value stocks (ex: Intel). With some investors eyeing the end of the coronavirus and the opening of the economy, the expectation is for ‘normal’ companies to finally catch up with their Covid-advantaged peers once again.

At the same time, the substantial government stimulus programs – $1,9 Trillion (with a T) dollars in the US alone –are stoking fears of future inflation. Interest rates are rising as a result, which not only squeezes the runway for lean tech startups but also puts significant downward pressure on bonds.

As of March 8th, the Canadian Bond Universe (FTSE/TMX) was -4.5% year-to-date, a far cry from the +8.7% it posted in 2020. To many, the idea that bonds might stand to lose more than 4% in three months is surprising. Our frequent readers will recall our October 2020 newsletter entitled Bothersome Bonds (https://inwp.ca/innova-market-insights/41-84-imi-bothersome-bonds.html) in which we explained why we felt this loss was likely. Investors in our private pool can take solace in the fact that we completed a significant shift out of bonds in Q3 and Q4 of 2020, moving from 26% bonds during ‘March Madness’ of 2020, down to ~10% at the time of this writing.

Despite the recent bump in the road, we feel that the prevailing optimism supplied by the potential end of the coronavirus is likely to keep the markets afloat near term. More to come on this subject in our upcoming quarterly private pool update!

Disclaimer:

Aligned Capital Partners Inc.(ACPI) is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Investment products are provided through ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Please contact Jean-François Démoré or Cliff Richardson, or visit https://invest.innovawealth.ca for additional information about the Innova Tactical Asset Fund. All non-securities related business conducted by Innova Wealth Partners is not as agent of ACPI. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Jean-François Démoré or Cliff Richardson.

Information has been compiled from sources believed to be reliable. All opinions expressed are as of the date of this publication and are subject to change without notice. Content is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The information contained does not constitute an offer or solicitation to buy or sell any investment fund, security or other product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI. For current performance information, please contact Innova Wealth Management of Aligned Capital Partners Inc. Important information about the Fund is contained in the offering memorandum which should be read carefully before investing.

- Hits: 1857