Issue #61 - The Big Dog Bares Big Teeth

Say what you will about Mr. Trump (and I do…), but investors have certainly been siding with his policies so far this year: US markets are up and international markets are down. In fact, 70% of Asian markets are down while more than half of European markets are posting losses year-to-date.

In large part, this can be explained by three major influences:

1- Tax Cuts

The substantial corporate tax cuts passed in 2017 are infusing a lot of additional capital into the US economy. As of last week, GDP figures have been revised upward to a very robust 3%, while unemployment rates are nearing all-time lows. Crucially, this has yet to lead to any substantial wage increases, and so it is very possible that this stimulus will be short-lived. Further, we have yet to see any real repatriation of corporate savings from off-shore jurisdictions, or any major long-term investments in manufacturing or infrastructure. For the time being however, the US markets are leading the way.

2- US Dollar

The growing US economy has allowed the Federal Reserve to start increasing interest rates. In turn, this has strengthened the US dollar against all other currencies that have been unable to match these increases. This has led US investors to favour investments in their home country rather than diversifying abroad, as the rising dollar has a negative impact on returns in those countries. As such, more and more dollars are flooding back into the US at the expense of international markets.

3- Trade tariffs

So far, trade war stories have dominated the news headlines, but have had a limited effect on the markets given their substantial potential for long-term harm. It seems that the markets are expecting sane discourse to prevail, and are seeing the current disputes as negotiating tactics for the Trump administration. In our opinion, the problem with that logic is that Trump doesn’t seem interested in the ‘Greater Good’ and appears to be willing to destroy mutually beneficial relationships if these align with his personal goals.

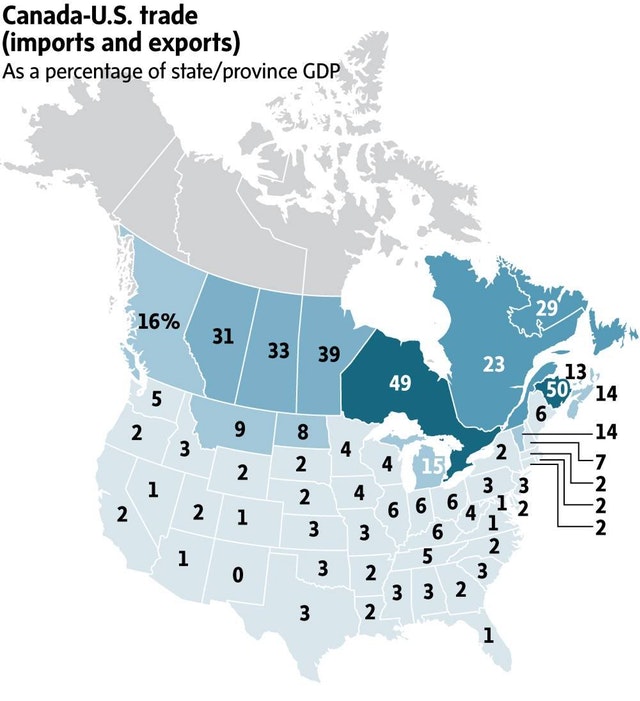

In last month’s newsletter, I shared the following chart which shows the percentage of each province or state’s economy that is tied to the Canada/US trade relationship.

As it so plainly shows, we are much more dependent on them, than they are on us - and they know it… More importantly, there is very little political risk for the Trump administration given that their substantial tax cuts will help curtail the damage that these trade policies will have.

Impact to investors

We feel that these ‘Trade Wars’ will likely end in one of three ways;

1- The US comes out a winner

2- China comes out a winner

3- Everyone loses

For that reason, we recommend a diversified approach to the markets with overweight positions in US growth, China and Cash. As always, we are pleased to discuss how this approach might be beneficial to your portfolio!

Innova Wealth Management is a trade name of Aligned Capital Partners Inc. (ACPI). Jean-François Démoré, as an agent of Innova Wealth Management/ACPI is registered to provide investment advice in the provinces of Ontario, Quebec, and British Columbia. Investment products are provided by ACPI, a member of the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and the Canadian Investor Protection Fund (www.cipf.ca). All non-securities related business conducted by J-F Demore as a representative of Innova Wealth Builders is not covered by the Canadian Investor Protection Fund and is not under the supervision of ACPI.

The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any securities mentioned. The views expressed are those of the author and not necessarily those of ACPI.

- Hits: 1789