FOMO Rally

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” - Benjamin Graham

When the big ball dropped announcing the New Year, the general consensus for the S&P500, the U.S.’ largest stock market, was that while valuations were a little high at 3,230 points[i] the economy would still continue to chug along nicely in 2020. Fast forward a few months later and a little-noticed virus had brought the world’s shipping lanes, factories, stores, and restaurants to a stand-still. Unemployment rates reached new historical records shortly thereafter and remain near all-time highs in both Canada (12.3%)[ii] and the U.S. (11.1%)[iii] for June 2020. Consumer spending and confidence sank and remain low, indicating dismal prospects for a rapid recovery. Although the economy may be opening, it is unclear as to whether wallets will open at the same speed.

Despite the sudden shock to the economy and the very real possibility of further lockdowns, as of July 13th, the S&P500 is now trading a mere 0.5%i below where it began the year. Due to quarterly reporting, most companies have yet to disclose their sales and profits for a full period impacted by COVID-19. As such, the market has shrugged off the economic damage before it has been completely reported on company financial statements, fueling the single fastest stock market recovery of the past decade.

In this IMI we shed some light on this stock market recovery, what we are calling the ‘FOMO Rally’.

The ‘Fear of Missing Out’ (FOMO) is an anxiety disorder[iv] that causes people to worry that they are ‘missing out’ on the fun that others are having. At its best, this feeling encourages people to try new things and ‘join the bandwagon’. However, in the age of social media in which timelines are flooded with people showcasing the best parts of their day, this fear has become a diagnosable disorder linked to unhappiness and depressioniv. With the social isolation that the ‘Great Lockdown’ introduced, people are increasingly relying on social media to stay connected which magnifies the effect of FOMO.

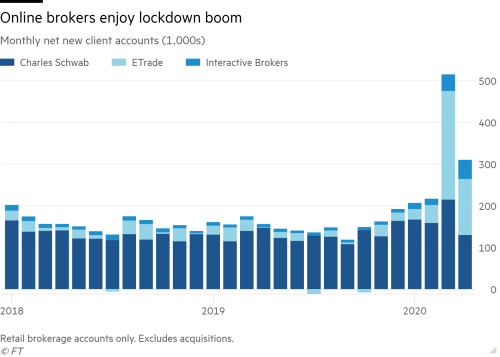

More recently, the closure of casinos as well as the lack of sporting events led to a marked increase in online gambling and, you guessed it, online trading. A record number of new personal trading accounts have been opened in the wake of COVID-19 with as many as 90% of them being opened by novice investors[v].

The greatest benefactor of this recent surge is a trading app called Robinhood where first-time traders added as many as 1.5 million new accounts in the US alone during the first four months of the year[vi]. Offering free stock trades, they took their cue from the temporarily shuttered casino slot machines by adding rewarding sounds and graphics in an attempt to ‘gamify’ stock trading.[vii]

The timing of stimulus cheques and free time on the hands of millions of furloughed Canadians and Americans exacerbated this trend. According to data gathered by CNBC, there was a 90% increase in the amount of money invested on the stock market for low to moderate income households the week that stimulus cheques were received in the US[viii].

All this newfound money heading into the stock market in conjunction with governments releasing their grip on the economy has led to a surge in stock prices. In this new post-COVID-19 environment, with every successful trade, there is an accompanying social media post from ’Robinhooders’ to add further fuel to the FOMO fire.

One particularly egregious example of bad advice is the so-called head of the ‘Robinhood army’, Davey Day Trader. The owner of Barstool Bets, an online betting and gambling site, shared these wonderful words of dubious wisdom with his more than 1.6M followers: “Stocks only go up, and if you have any problems, see rule No. 1”. To prove his point, he picked three letters out of a scrabble bag and placed his bets, before encouraging his ‘army’ to do the same.

When a rising tide lifts all boats, no harm, no foul. We have always been proponents of individuals learning more about the markets and taking greater interest in their personal finances. We also love hearing stories about the guy who bought some big name stock just before it skyrocketed and made a bundle. The issue is that those stories sound identical to gambling tales; people will always tell you about their big wins but will shy away from sharing their losses.

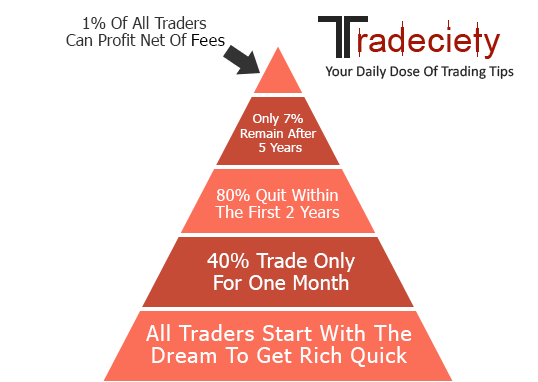

The cold hard facts are that, according to studies discussed in this article, only 3% of Brazilian day traders are successful over the long-term. Other studies seem to indicate that the number sits somewhere between 1 and 10%[ix]. The overwhelming majority lose money over time and in doing so may drastically impact their financial lives, sometimes with tragic consequences. The extent to which some of these vulnerable investors are in over their heads can be downright scary. Take the following stories from this BNN article as examples:

- Novice investors piled into a Chinese penny stock called ‘Zoom Technologies’, skyrocketing the share price 240% before the SEC suspended trading of the share due to suspicions that the share was being mistaken for ‘Zoom Video Communications’.

- A Chinese company named FANGDD saw a 1000%+ increase in its share price, suspected due to rookie investors who thought it was a way to invest in the famed ‘FANG’ (Facebook, Amazon, Netflix, Google) stocks.

- The sudden 50-100% jump in the share price of companies that have effectively filed for bankruptcy (Hertz, JC Penney, etc.) following Twitter comments from the ‘Robinhooders’.

- 40,000 individual Robinhooders bought up shares in Tesla, only to see the stock plummet hours later.

Although anecdotally funny, the financial implications are not. For anyone to have made money selling the stock, someone had to be buying it and those who bought near the top only have steep losses to show for their efforts.

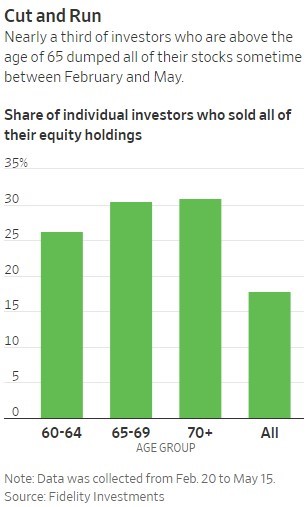

Similarly, many other self-directed investors showed signs of FOMO. In the depths of the crash, many investors hit their panic point and began to sell stocks in an attempt to mitigate their mounting losses. Falling interest rates means that new bond investors are not earning enough to finance their retirements and so have had to increase the amount of stocks in their portfolio. Stomaching the ups and downs of the market is notoriously difficult however, especially without guidance.

No matter how many times the old adage of ‘buy-low, sell-high’ is repeated, every correction includes a fresh group of investors who capitulate under the stress and sell at the bottom. According to the Wall Street Journal’s analysis of Fidelity Investment trading data, almost 1/5[x] of individuals sold ALL of their stocks between February and May of this year[xi]. Not some of their shares, but ALL of their shares… Sadly, the proportions are even higher for older individuals.

As the stock market recovery began, these same investors watched from the sidelines nursing their wounds but not taking part of the recovery. They watched the index climb higher while worrying about ‘missing their chance’ to get back into the market until finally, after the first 10-15-20% of the recovery slipped by, they came crawling back with hat in hand.

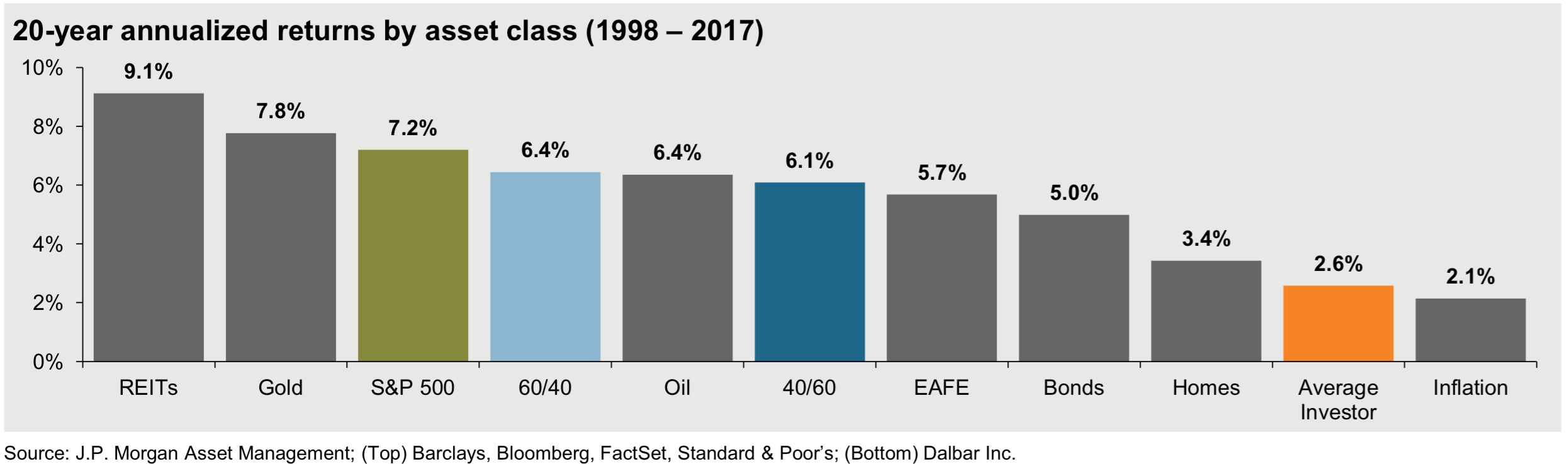

This is the way that investors destroy their wealth and is one of the main reasons that individual investors underperformed the stock markets and professionals by almost half (Source 1, 2).

Our take has consistently been that there are two ways to use the stock market; as a way to gamble (speculate) or as a way to build wealth (invest). We continue to believe that if a company can double overnight, it can also be halved just as quickly, and so these are not the areas in which we want to put our retirement nest eggs. Companies that have established themselves as capable of earning profits in good markets and bad and who have consistently rewarded their shareholders by growing the company or paying dividends are more in line with our investment philosophy.

Although it isn’t sexy and you won’t be the one bragging to your friends that you doubled your money in a week, you also won’t be the one having to shy away from talking about your losses, understanding that it is in those times that ‘buying low’ occurs.

According to Benjamin Graham, the father of value investing, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” We were more than happy to profit from the recent run-up on the stock market by increasing our allocations to stocks within the Tactical Asset Allocation Private Pool. At this time, however, we expect the votes to turn once the financial statements showing the impact of COVID-19 are released and have positioned ourselves accordingly.

Sources:

[i] Yahoo Finance: https://ca.finance.yahoo.com/quote/%5EGSPTSE/history?p=%5EGSPTSE

[ii] Canada Employment Rates : https://tradingeconomics.com/canada/unemployment-rate#:~:text=Unemployment%20Rate%20in%20Canada%20is,9.00%20in%2012%20months%20time.

[iii] US Employment Rates : https://tradingeconomics.com/united-states/unemployment-rate

[iv] FOMO : https://en.wikipedia.org/wiki/Fear_of_missing_out#:~:text=Fear%20of%20missing%20out%20(FOMO,with%20what%20others%20are%20doing.

[v] Record retail trading could be due to coronavirus-driven lack of gambling options : https://www.axios.com/retail-investors-gambling-casinos-closed-coronavirus-951eefc6-f744-4e49-ac41-cf6036a52f38.html

[vi] Why Robinhood investors have an outsized impact on the market : https://www.bnnbloomberg.ca/this-is-why-robinhood-investors-have-an-outsized-impact-on-the-market-1.1460420

[vii] Robinhood Has Gamified Online Trading Into an Addiction : https://marker.medium.com/robinhood-has-gamified-online-trading-into-an-addiction-cc1d7d989b0c

[viii] The Rise of Robinhood and its implications : https://seekingalpha.com/article/4354679-rise-of-robinhood-traders-and-implications

[ix] Day Trading: Smart or Stupid : https://www.forbes.com/sites/nealegodfrey/2017/07/16/day-trading-smart-or-stupid/#4ae5750f1007

[x] Investors Approaching Retirement Face Painful Decisions : https://www.wsj.com/articles/investors-approaching-retirement-face-painful-decisions-11592213401

[xi] When should you sell your stocks? : https://awealthofcommonsense.com/2020/06/when-should-you-sell-your-stocks/#:~:text=Fidelity%20data%20shows%20nearly%20one,out%20of%20stocks%20in%20March.

Disclaimer:

Aligned Capital Partners Inc.(ACPI) is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). Investment products are provided through ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Please contact Jean-François Démoré or Cliff Richardson, or visit https://invest.innovawealth.ca for additional information about the Innova Tactical Asset Fund. All non-securities related business conducted by Innova Wealth Partners is not as agent of ACPI. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Jean-François Démoré or Cliff Richardson.

Information has been compiled from sources believed to be reliable. All opinions expressed are as of the date of this publication and are subject to change without notice. Content is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The information contained does not constitute an offer or solicitation to buy or sell any investment fund, security or other product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI. For current performance information, please contact Innova Wealth Management of Aligned Capital Partners Inc. Important information about the Fund is contained in the offering memorandum which should be read carefully before investing.

- Hits: 1924